On September 1, 2024, Speedy Lube signed a 30-year, $1,080,000 mortgage note payable to Jonstown Bank and

Question:

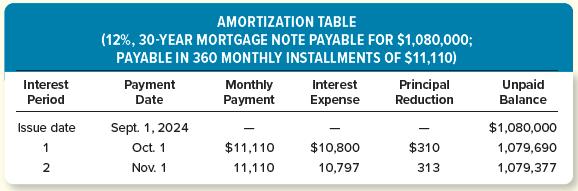

On September 1, 2024, Speedy Lube signed a 30-year, $1,080,000 mortgage note payable to Jonstown Bank and Trust in conjunction with the purchase of a building and land. The mortgage note calls for interest at an annual rate of 12 percent (1 percent per month). The note is fully amortizing over a period of 360 months.

The bank sent Speedy Lube an amortization table showing the allocation of monthly payments between interest and principal over the life of the loan. A small part of this amortization table is illustrated as follows:

Instructions

a. Explain whether the amounts of interest expense and the reductions in the unpaid principal are likely to change in any predictable pattern from month to month.

b. Prepare journal entries to record the first two monthly payments on this mortgage.

c. Complete this amortization table for two more monthly installments—those due on December 1, 2024, and January 1, 2025.

d. Will any amounts relating to this 30-year mortgage be classified as current liabilities in Speedy Lube’s December 31, 2024, balance sheet? Explain, but you need not compute any additional dollar amounts.

Step by Step Answer:

Financial And Managerial Accounting The Basis For Business Decisions

ISBN: 9781264445240

20th Edition

Authors: Jan Williams, Susan Haka, Mark Bettner