Bernese plc develops and manufactures drills for businesses operating in the oil and gas industry. Although it

Question:

Bernese plc develops and manufactures drills for businesses operating in the oil and gas industry. Although it is committed to maximising the wealth of its shareholders, the business has incurred heavy losses over recent years. A new chief executive has now been appointed to revive the flagging fortunes of the business. As part of the revival process, a review has been ordered of all projects involving new drills that were either still being developed or were already developed and about to be launched.

Project XK150 began in Year 6 and has incurred costs of £4 million, to date, in developing and testing a new drill for use in offshore oil rigs. The project had experienced numerous problems and the drill has taken longer than expected to develop but it will be ready to market from December Year 7. The new drill is expected to generate sales over a four-year period, after which it will be replaced with an improved version.

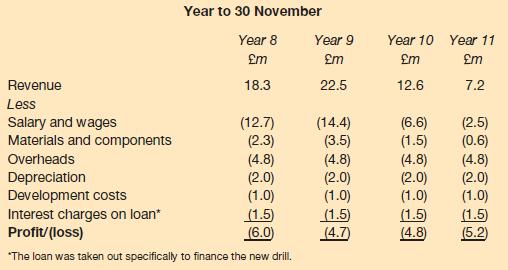

The manager of Project XK150 has produced the following calculations to aid the review process:

The manager of Project XK150 is dismayed by the above results and believes that the new chief executive will call an immediate halt to the proposed launch when the results are presented to him. Before making the presentation, however, the project manager has asked you to check the figures that he has produced.

When going through the figures, you find the following:

(i) The materials and components are already held in inventories and were purchased specifically for producing the new drills. The materials and components are highly specialised and cannot be used for any other project. They have no ready market value and, if the new drills are not manufactured, the materials and components will have to be disposed of immediately at a cost to the business of £0.2 million.

(ii) The overheads reflect a 'fair share' of the total overheads incurred by the business. However, the overheads that relate specifically to the project account for only 25 per cent of the amount shown in each period.

(iii) The depreciation charge relates to existing plant and equipment which will be required for the manufacture of the new drills. This plant and equipment has a current carrying (net book) value of £8.0 million and a current resale value of £6.0 million. If the project goes ahead, the plant and equipment will be sold for £2.0 million at the end of the project's life.

(iv) Working capital of £2.5 million will be required immediately and will be released at the end of the four-year period of the life of the new drills.

(v) The development costs relate to the costs incurred during the period up to 30 November Year 7. It is the policy of the company to write off development costs in equal annual instalments over the period in which revenues are generated.

(vi) Interest charges arise from a loan that was taken out to help finance the development and manufacture of the new drills. You can assume the calculations provided by the manager of Project XK150 contain no arithmetic errors.

The business has a cost of capital of 10 per cent.

Ignore taxation.

Required:

(a) Calculate the net present value of the new drill and briefly comment on the viability of the project.

(b) Briefly explain the reasons for any adjustments that you have made to the figures provided by the manager of Project XK150 in order to calculate the net present value of the new drill.

Step by Step Answer: