Cumberland Industries' common stock has increased in price from $14.75 to $17.25 from the end of 2006

Question:

Cumberland Industries' common stock has increased in price from $14.75 to $17.25 from the end of 2006 to the end of 2007, and its shares outstanding increased from 9 to 10 million shares during that same period. Cumberland has annual lease payments of $75,000 (which are included in operating costs on the income statement), but no sinking fund payments are required. Now answer the following questions.

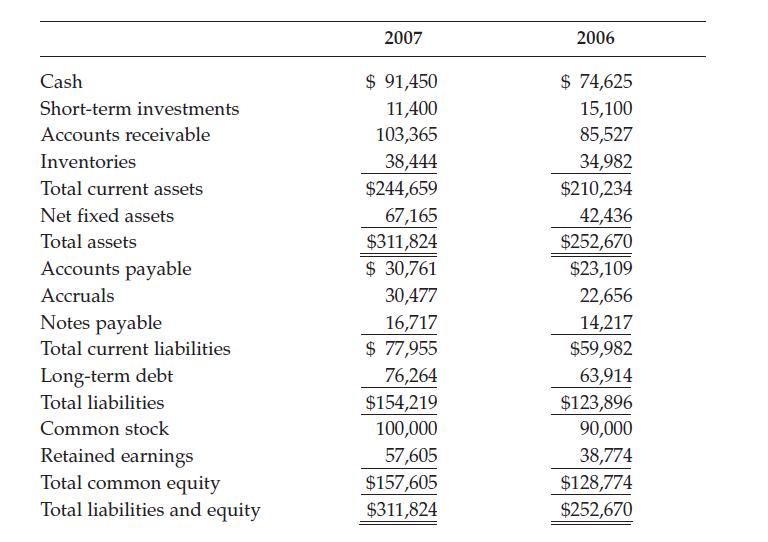

Using Cumberland's financial statements as given in the Chapter 3 Build a Model problem, perform a ratio analysis for 2006 and 2007. Consider its liquidity, asset management, debt management, profitability, and market value ratios.

Financial statements

a. Has Cumberland's liquidity position improved or worsened? Explain.

b. Has Cumberland's ability to manage its assets improved or worsened? Explain.

c. How has Cumberland's profitability changed during the last year?

d. Perform an extended Du Pont analysis for Cumberland for 2006 and 2007.

e. Perform a common size analysis. What has happened to the composition (that is, percentage in each category) of assets and liabilities?

f. Perform a percent change analysis. What does this tell you about the change in profitability and asset utilization?

Step by Step Answer:

Financial Management Theory & Practice

ISBN: 9780324652178

12th Edition

Authors: Eugene BrighamMichael Ehrhardt