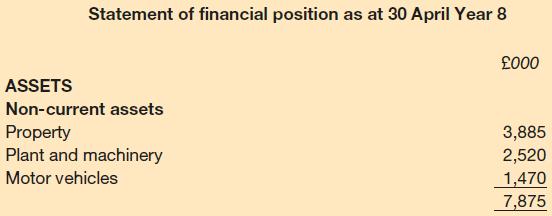

Hatleigh plc is an engineering business. The financial statements for the year ended 30 April Year 8

Question:

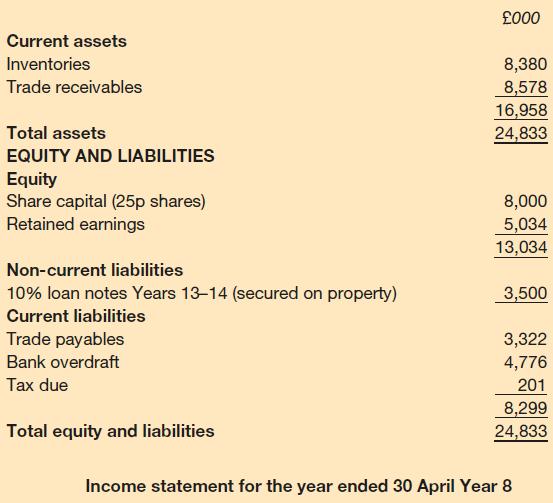

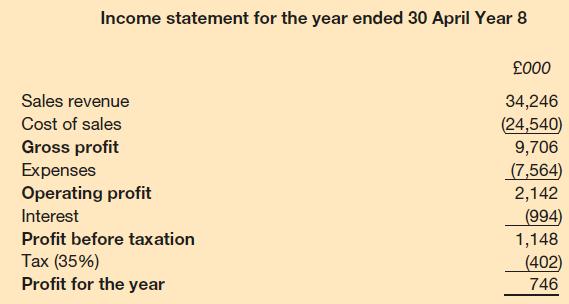

Hatleigh plc is an engineering business. The financial statements for the year ended 30 April Year 8 are as follows:

A dividend of £600,000 was proposed and paid during the year.

The business made a one-for-four rights issue of ordinary shares during the year. Sales for the forthcoming year are forecast to be the same as for the year to 30 April Year 8. The gross profit margin is likely to stay the same as in previous years but expenses (excluding interest payments) are likely to fall by 10 per cent as a result of economies.

The bank has been concerned that the business has persistently exceeded the agreed overdraft limits and, as a result, the business has now been asked to reduce its overdraft to £3 million over the next three months. The business has agreed to do this and has calculated that interest on the bank overdraft for the forthcoming year will be £440,000 (after taking account of the required reduction in the overdraft). In order to achieve the reduction in overdraft, the chairman of Hatleigh plc is considering either the issue of more ordinary shares for cash to existing shareholders at a discount of 20 per cent, or the issue of more 10 per cent loan notes redeemable Years 13–14 at the end of July Year 8. It is believed that the share price will be £1.50 and the 10 per cent loan notes will be quoted at £82 per £100 nominal value at the end of July Year 8. The bank overdraft is expected to remain at the amount shown in the statement of financial position until that date. Any issue costs relating to new shares or loan notes should be ignored.

Required:

(a) Calculate:

(i) the total number of shares (ii) the total nominal value of loan notes that will have to be issued in order to raise the funds necessary to reduce the overdraft to the level required by the bank.

(b) Calculate the projected earnings per share for the year to 30 April Year 9 assuming:

(i) the issue of shares (ii) the issue of loan notes are carried out to reduce the overdraft to the level required by the bank.

(c) Critically evaluate the proposal of the chairman to raise the necessary funds by the issue of:

(i) shares (ii) loan notes.

Step by Step Answer: