Crane Rafting Corporation is considering an acquisition of Frost Ski Supplies. Frost has a pre-merger 8% unlevered

Question:

Crane Rafting Corporation is considering an acquisition of Frost Ski Supplies. Frost has a pre-merger 8% unlevered cost of equity, 6% pre-tax cost of debt, and 25% tax rate. Its pre-merger forecasted free cash flows and debt are expected to grow at a constant 5% rate after Year 4. Frost has 800 million outstanding shares.

If Crane makes the acquisition, synergies will increase Frost?s free cash flows.

Crane will also add debt at Frost?s 6% rate. Crane?s tax rate is 25%. The post-merger forecasted free cash flows and debt are expected to grow at a constant 5% rate after Year 4.

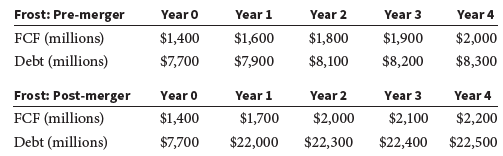

Data for Frost?s pre-merger and post-merger FCF and debt are shown here:

a. What is Frost?s pre-merger unlevered horizon value? What is its Year-0 unlevered value?

b. What is Frost?s pre-merger horizon value tax shield? What is its Year-0 tax shield value? Assume debt is added on the first day of the year; that is, calculate interest expenses for Year t based on debt at Year t.

c. What is Frost?s current value of levered operations? What is its value of equity? What is the minimum stock price per share that Frost?s shareholders should accept?

d. What is Frost?s post-merger unlevered horizon value to Crane? What is its Year-0 unlevered value?

e. What is Frost?s post-merger horizon value tax shield to Crane? What is its Year-0 tax shield value? Assume debt is added on the first day of the year; that is, calculate interest expenses for Year t based on debt at Year t.

f. What is Frost?s post-merger Year-0 value of levered operations to Crane? What is its value of equity? (Hint: Remember that Crane assumes Frost?s debt and subsequently issues more debt.) What is the maximum stock price per share that Crane should offer?

g. What percentage of Frost?s pre-merger capital structure at Year 4 consisted of debt? You already have the values you need to calculate the total value at the horizon.

What percentage after the merger? How much of Frost?s post-merger increase in value to Crane is due to improved FCF?

Capital StructureCapital structure refers to a company’s outstanding debt and equity. The capital structure is the particular combination of debt and equity used by a finance its overall operations and growth. Capital structure maximizes the market value of a... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may...

Step by Step Answer:

Financial Management Theory and Practice

ISBN: 978-1337902601

16th edition

Authors: Eugene F. Brigham, Michael C. Ehrhardt