Joshua & White (J&W) Technologies's financial statements are also shown below. Answer the following questions. (Note: Industry

Question:

Joshua & White (J&W) Technologies's financial statements are also shown below. Answer the following questions. (Note: Industry average ratios are provided in Ch03 Build a Model.xlsx.)

a. Has J&Ws liquidity position improved or worsened? Explain.

b. Has J&Ws ability to manage its assets improved or worsened? Explain.

c. How has J&Ws profitability changed during the past year?

d. Perform an extended DuPont analysis for J&W for 2014 and 2015. What do these results tell you?

e. Perform a common size analysis. What has happened to the composition (that is, percentage in each category) of assets and liabilities?

f. Perform a percentage change analysis. What does this tell you about the change in profitability and asset utilization?

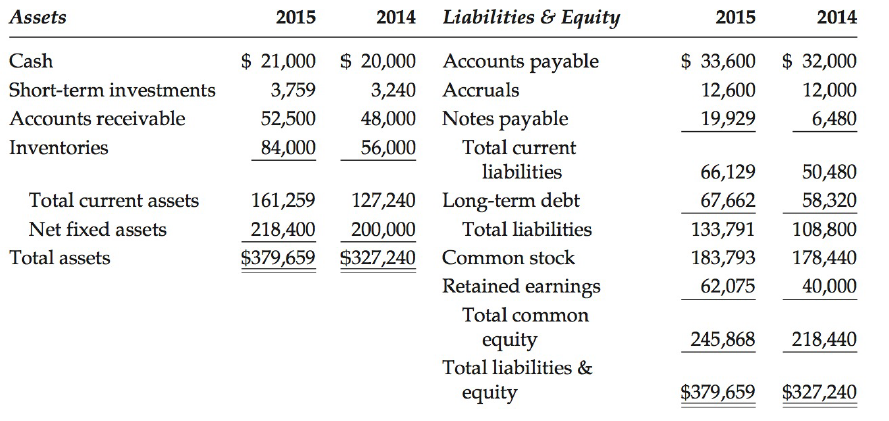

Joshua & White Technologies: December 31 Balance Sheets (Thousands of Dollars)

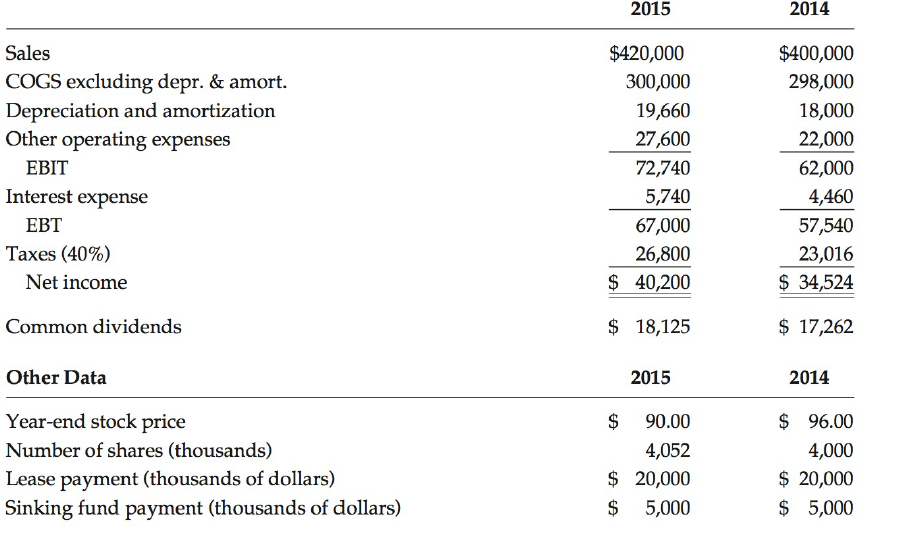

Joshua & White Technologies December 31 Income Statements (Thousands of Dollars)

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Step by Step Answer:

Financial Management Theory And Practice

ISBN: 978-0176583057

3rd Canadian Edition

Authors: Eugene Brigham, Michael Ehrhardt, Jerome Gessaroli, Richard Nason