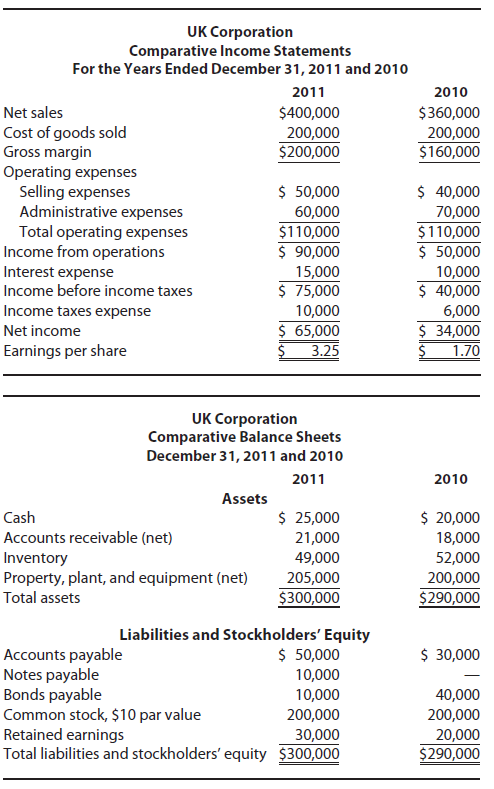

The condensed comparative income statements and balance sheets of UK Corporation are presented on the next page.

Question:

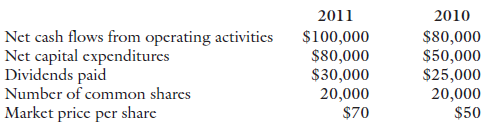

The condensed comparative income statements and balance sheets of UK Corporation are presented on the next page. All figures are given in thousands of dollars, except earnings per share and market price per share. Additional data for UK Corporation in 2011 and 2010 are as follows:

Balances of selected accounts at the end of 2009 were accounts receivable (net), $15,000; inventory, $50,000; accounts payable, $24,000; total assets, $250,000; and stockholders’ equity, $200,000. All of the bonds payable were long-term liabilities.

Required

Perform a comprehensive ratio analysis. Round percentages and ratios to one decimal place.

1. Prepare a liquidity analysis by calculating for each year the (a) current ratio, (b) quick ratio, (c) receivable turnover, (d) days’ sales uncollected, (e) inventory turnover, (f) days’ inventory on hand, (g) payables turnover, and (h) days’ payable.

2. Prepare a profitability analysis by calculating for each year the (a) profit margin, (b) asset turnover, (c) return on assets, and (d) return on equity.

3. Prepare a long-term solvency analysis by calculating for each year the (a) debt to equity ratio and (b) interest coverage ratio.

4. Prepare a cash flow adequacy analysis by calculating for each year the (a) cash flow yield, (b) cash flows to sales, (c) cash flows to assets, and (d) free cash flow.

5. Prepare an analysis of market strength by calculating for each year the (a) price/earnings (P/E) ratio and (b) dividends yield.

6. After making the calculations, indicate whether each ratio improved or deteriorated from 2010 to 2011 (use F for favorable and U for unfavorable and consider changes of 0.1 or less to be neutral).

SolvencySolvency means the ability of a business to fulfill its non-current financial liabilities. Often you have heard that the company X went insolvent, this means that the company X is no longer able to settle its noncurrent financial...

Step by Step Answer:

Financial and Managerial Accounting

ISBN: 978-1439037805

9th edition

Authors: Belverd E. Needles, Marian Powers, Susan V. Crosson