An APT model is based on three mutually independent systematic factors (F_{1}, F_{2}), and (F_{3}). The annual

Question:

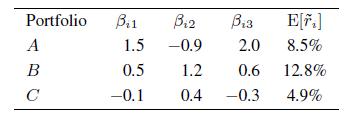

An APT model is based on three mutually independent systematic factors \(F_{1}, F_{2}\), and \(F_{3}\). The annual risk-free rate, with annual compounding, is \(4 \%\) (below we assume annual returns). We consider three well-diversified portfolios, \(i=A B C\), with the following features:

- Find the coefficients characterizing the APT model.

- Find the expected return of a portfolio with unit exposure to \(F_{1}\), neutral to \(F_{2}\) and \(F_{3}\).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

An Introduction To Financial Markets A Quantitative Approach

ISBN: 9781118014776

1st Edition

Authors: Paolo Brandimarte

Question Posted: