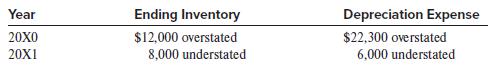

Bettner, Inc., is a calendar-year corporation whose financial statements for 20X0 and 20X1 included errors as follows:

Question:

Bettner, Inc., is a calendar-year corporation whose financial statements for 20X0 and 20X1 included errors as follows:

Assume that inventory purchases were recorded correctly and that no correcting entries were made at December 31, 20X0, or December 31, 20X1. The errors were discovered in 20X2, after the 20X1 financial statements were issued.

Required:

1. Ignoring income taxes, prepare the journal entry Bettner would make in 20X2 to correct the errors.

2. Describe the content of the comparative periods in Bettner’s 20X2 financial statements. That is, how is the correction reflected in the 20X2 financial report?

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer