Neville Company decides at the beginning of 20X3 to adopt the FIFO method of inventory valuation. It

Question:

Neville Company decides at the beginning of 20X3 to adopt the FIFO method of inventory valuation. It had used the LIFO method for financial reporting since its inception on January 1, 20X1, and had maintained records that are sufficient to retrospectively apply the FIFO method. Neville concluded that the FIFO method is the preferable inventory valuation method for its inventory (it was the lone member of its industry that used LIFO; its competitors all valued inventory using FIFO).

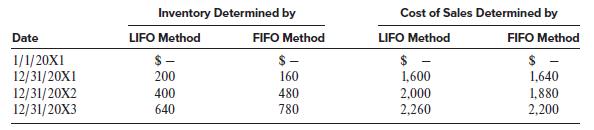

The effects of the change in accounting principle on inventory and cost of sales are presented in the following table:

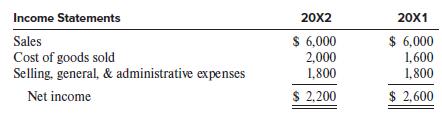

For 20X1, 20X2, and 20X3, assume that sales are $6,000 and selling, general, and administrative expenses are $1,800. Neville’s annual report provides two years of financial results. The company’s income statements as originally reported under the LIFO method follow.

Ignore income taxes.

Required:

1. Prepare Neville Company’s 20X3 and 20X2 income statements reflecting the retrospective application of the accounting change from the LIFO method to the FIFO method.

2. Prepare Neville Company’s disclosure related to the accounting change; limit disclosure of financial statement line items affected by the change in accounting principle to those appearing on the company’s income statements for the years presented.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer