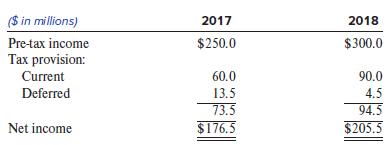

In early 2017, Quintana Corporation prepared the following forecast of its earnings for 2017 and 2018: Quintanas

Question:

In early 2017, Quintana Corporation prepared the following forecast of its earnings for 2017 and 2018:

Quintana’s pre-tax income forecasts include $40 million of nontaxable income in 2017 and $30 million of nontaxable income in 2018. These were the only permanent differences in the forecasts.

Quintana had a net deferred tax liability position of $610 million at December 31, 2016. It has no other comprehensive income. The forecasted tax provisions were based on the 35% federal corporate tax rate that was in effect when the forecasts were made. Quintana is not subject to any state or foreign income taxes.

Quintana is now preparing revised forecasts to reflect the effects of the federal corporate tax rate reduction to 21% that was enacted in 2017, effective in 2018. The revised forecasts will assume no changes to the amount or composition of pre-tax income in either 2017 or 2018 relative to the original forecasts. That is, forecasted pre-tax income is to remain at $250 million and $300 million in 2017 and 2018, respectively, and there will be the same permanent differences of $40 million and $30 million.

Required:

1. Determine the revised forecasts of Quintana’s deferred tax liability at December 31, 2017, and December 31, 2018.

2. Prepare revised earnings forecasts for 2017 and 2018 in the same format as the original forecasts provided in the problem.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer