Mattel, Inc., develops and manufacturers toys that it sells globally. Presented below are excerpts from its Form

Question:

Mattel, Inc., develops and manufacturers toys that it sells globally. Presented below are excerpts from its Form 10-K for the year ended December 31, 2018.

NOTE 10—DERIVATIVE INSTRUMENTS

Mattel seeks to mitigate its exposure to foreign currency transaction risk by monitoring its foreign currency transaction exposure for the year and partially hedging such exposure using foreign currency forward exchange contracts. Mattel uses foreign currency forward exchange contracts as cash flow hedges primarily to hedge its purchases and sales of inventory denominated in foreign currencies. These contracts generally have maturity dates of up to 18 months. These derivative instruments have been designated as effective cash flow hedges, whereby the unsettled hedges are reported in Mattel’s consolidated balance sheets at fair value, with changes in the fair value of the hedges reflected in other comprehensive income (“OCI”). Realized gains and losses for these contracts are recorded in the consolidated statements of operations in the period in which the inventory is sold to customers. Additionally, Mattel uses foreign currency forward exchange contracts to hedge intercompany loans and advances denominated in foreign currencies. Due to the short-term nature of the contracts involved, Mattel does not use hedge accounting for these contracts, and as such, changes in fair value are recorded in the period of change in the consolidated statements of operations. As of December 31, 2018 and 2017, Mattel held foreign currency forward exchange contracts with notional amounts of $962.1 million and $987.7 million, respectively.

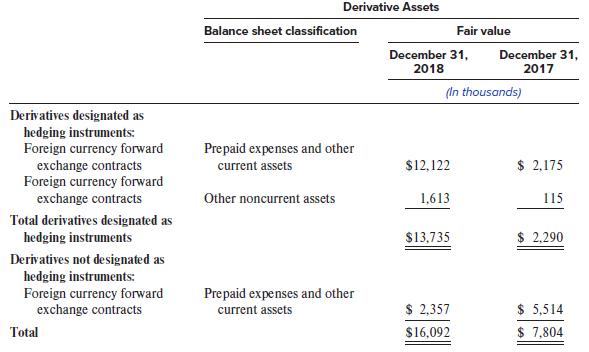

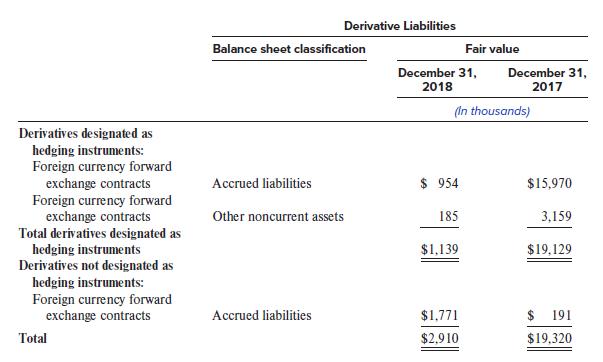

The following table presents Mattel’s derivative assets and liabilities:

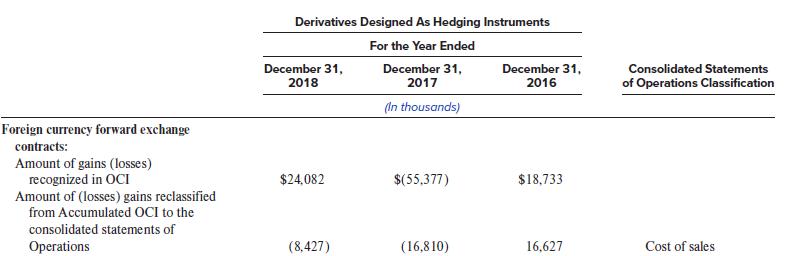

The net (losses) gains of $(8.4) million, $(16.8) million, and $16.6 million reclassified from accumulated other comprehensive loss to the consolidated statements of operations during 2018, 2017, and 2016, respectively, are offset by the changes in cash flows associated with the underlying hedged transactions.

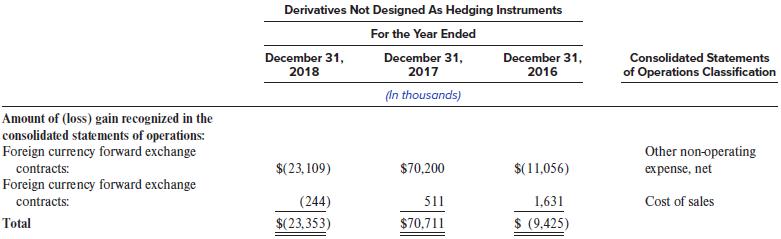

The net (losses) gains of $(23.4) million, $70.7 million, and $(9.4) million recognized in the consolidated statements of operations during 2018, 2017, and 2016, respectively, are offset by foreign currency transactions gains and losses on the related hedged balances.

Required:

1. In 2018, Mattel has $16,092,000 total derivatives classified as assets and $2,910,000 total derivatives classified as liabilities. Explain how these amounts relate to the notional amounts of $962.1 million discussed in the first paragraph of Note 10.

2. Explain why the derivatives classified as assets aren’t netted with the derivatives classified as liabilities.

3. Refer to the schedule detailing how Derivatives Designated As Hedging Instruments affect the income statement. Explain why gains (losses) would be classified as Cost of sales instead of Other non-operating expense, net.

4. Refer to the schedule detailing how the Derivatives Designated As Hedging Instruments affect OCI and net income. Explain why the $24,082,000 and $(8,427,000) are disclosed separately.

5. Refer to the schedule detailing how the Derivatives Designated as Hedging Instruments affect OCI and net income. Explain how the gains (losses) affect OCI, comprehensive income, and Accumulated OCI in 2018.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer