Presented below is information from Toys R Us, Inc., Form 10-K for the fiscal years ending January

Question:

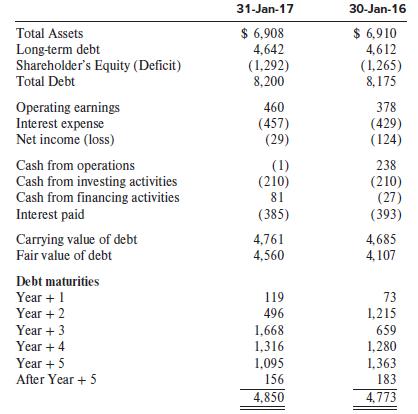

Presented below is information from Toys “R” Us, Inc., Form 10-K for the fiscal years ending January 31, 2017, and January 30, 2016.

On August 16, 2016, we completed the offering to exchange the outstanding 10.375% senior notes due 2017 (the “2017 Notes”) and 7.375% senior notes due 2018 (the “2018 Notes” and, together with the 2017 Notes, the “Senior Notes”) for new 12.000% senior secured notes due 2021 (the “Taj Notes”) issued by the Taj Note Issuers (as defined below) and, in the case of the 2017 Notes, $110 million in cash. An additional $34 million of Taj Notes were issued in concurrent private placements, of which $26 million were issued for cash, with the remainder issued as payment to certain noteholders in connection with the Exchange Offers (as defined below). On August 26, 2016, the Taj Note Issuers issued $142 million in additional Taj Notes in a private placement, of which a portion of the proceeds was used to redeem the remaining 2017 Notes. As a result of these transactions, all of the 2017 Notes, in an aggregate principal amount of $450 million, and $192 million of the 2018 Notes were exchanged or redeemed, with $208 million in principal of the 2018 Notes still outstanding. The aggregate principal amount of Taj Notes issued was $583 million.

As of January 28, 2017, we had total indebtedness of $4.8 billion, of which $3.4 billion was secured indebtedness. Toys “R” Us, Inc. is a holding company and conducts its operations through its subsidiaries, certain of which have incurred their own indebtedness. Our credit facilities, loan agreements and indentures contain customary covenants that, among other things restrict our ability to:

• Incur certain additional indebtedness;

• Transfer money between the Parent Company and our various subsidiaries;

• Pay dividends on, repurchase or make distributions with respect to our or our subsidiaries’ capital stock or make other restricted payments;

• Issue stock of subsidiaries;

• Make certain investments, loans or advances;

• Transfer and sell certain assets;

• Create or permit liens on assets;

• Consolidate, merge, sell or otherwise dispose of all or substantially all of our assets;

• Enter into certain transactions with our affiliates; and

• amend certain documents.

The amount of total net assets that were subject to such restrictions was $59 million as of January 28, 2017. Our agreements also contain various and customary events of default with respect to the indebtedness, including, without limitation, the failure to pay interest or principal when the same is due under the agreements, cross default and cross acceleration provisions, the failure of representations and warranties contained in the agreements to be true and certain insolvency events. If an event of default occurs and is continuing, the principal amounts outstanding thereunder, together with all accrued and unpaid interest and other amounts owed thereunder, may be declared immediately due and payable by the lenders. We are dependent on the borrowings provided by the lenders to support our working capital needs, capital expenditures and to service debt. As of January 28, 2017, we have funds available to finance our operations under our $1.85 billion secured revolving credit facility (“ABL Facility”) through March 2019, subject to an earlier springing maturity, our two Toys-Japan unsecured credit lines through June 2017 and June 2018, and our European ABL Facility through December 2020. In addition, Asia JV and Toys-Japan have uncommitted lines of credit due on demand.

Source: Toys “R” Us, Inc., Forms 10-K for the fiscal years ending January 31, 2017, and January 30, 2016.

Required:

In September 2017, Toys “R” Us, Inc., filed for Chapter 11 bankruptcy. Identify and explain items in the above financial information that indicate financial weakness.

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer