The following information is taken from the financial statements of Ramsay Health Care Inc.: Required: 1. Reconstruct

Question:

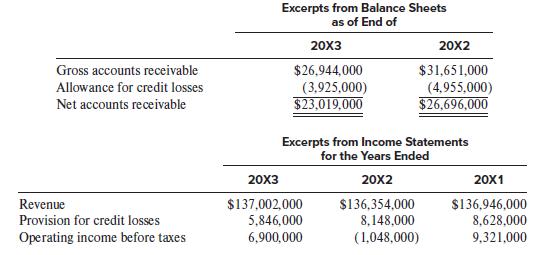

The following information is taken from the financial statements of Ramsay Health Care Inc.:

Required:

1. Reconstruct all journal entries relating to Gross accounts receivable and Allowance for credit losses for the year ended December 31, 20X3. You may assume that all revenues are from credit sales.

2. Assume that the company computes its provision for credit losses by multiplying sales revenues by some percentage (called the sales revenue approach). Recalculate the provision for credit losses for 20X3; assume that Ramsay estimated the 20X3 bad debts at the same percentage of revenue as it did in 20X2. Based on the revised figure, show how to present Gross accounts receivable and Allowance for credit losses as of the end of 20X3. Also calculate a revised operating income before taxes using the revised figure for the provision for credit losses.

3. In answering this part, assume that the company is using the gross accounts receivable approach to estimate its provision for credit losses (that is, assume that Allowance for credit losses is fixed as a percentage of gross receivables). Recalculate the provision for credit losses for 20X3 and the ending balance in Allowance for credit losses at the end of 20X3; assume that Ramsay estimated the expected bad debts at the same percentage of receivables as it did in 20X2. Also, calculate the revised operating income before taxes using the revised figure for the provision for credit losses.

4. Based on your answers to requirements 2 and 3, what inferences can be drawn about Ramsay’s accounts receivable management and the adequacy of the Allowance for credit losses?

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer