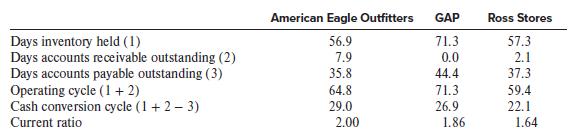

The following table reports the operating cycle, cash conversion cycle, and current ratio for three apparel retailers

Question:

The following table reports the operating cycle, cash conversion cycle, and current ratio for three apparel retailers all having year-ends at February 3, 2018. American Eagle Outfitters is a multibrand specialty retailer of casual apparel and accessories. The GAP built its brand name on basic, casual clothing and expanded its market by opening Banana Republic and Old Navy Stores. Ross Stores operates Ross Dress for Less® stores, which primarily target middle-income households.

All three companies follow the industry practice of including occupancy costs in cost of goods sold.

Required:

1. Do any of these companies appear to have a short-term liquidity problem?

2. How does the industry practice of including occupancy costs in cost of goods sold affect the statistics presented in the above table?

3. What is the most likely explanation for Ross Stores’s 2.1 days accounts receivable outstanding?

4. What is the most likely explanation for 0.0 days accounts receivable outstanding at The GAP?

Step by Step Answer:

Financial Reporting And Analysis

ISBN: 9781260247848

8th Edition

Authors: Lawrence Revsine, Daniel Collins, Bruce Johnson, Fred Mittelstaedt, Leonard Soffer