A company starts operations with no inventory at the beginning of a fiscal year and makes purchases

Question:

A company starts operations with no inventory at the beginning of a fiscal year and makes purchases of a good for resale five times during the period at increasing prices.

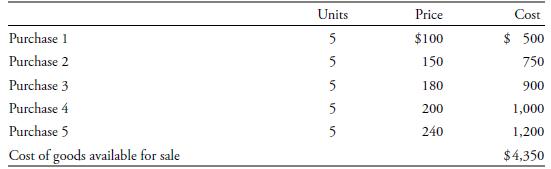

Each purchase is for the same number of units of the good. The purchases, and the cost of goods available for sale, appear in the following table. Notice that the price per unit has increased by 140% by the end of the period.

During the period, the company sells all of the goods purchased except for fi ve of them. Although the ending inventory consists of fi ve units, the cost attached to those units can vary greatly.

1. What are the ending inventory and cost of goods sold if the company uses the FIFO method of inventory costing?

2. What are the ending inventory and cost of goods sold if the company uses the weighted-average method of inventory costing?

3. Compare cost of goods sold and gross profit calculated under the two methods.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie