Groupon is an online discount merchant. In the companys initial S-1 registration statement in 2011, then-CEO Andrew

Question:

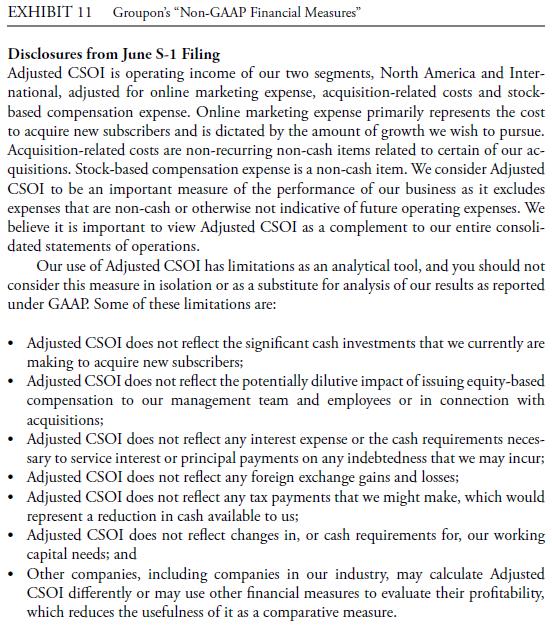

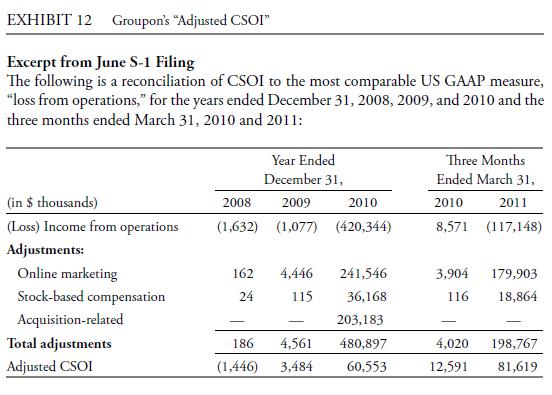

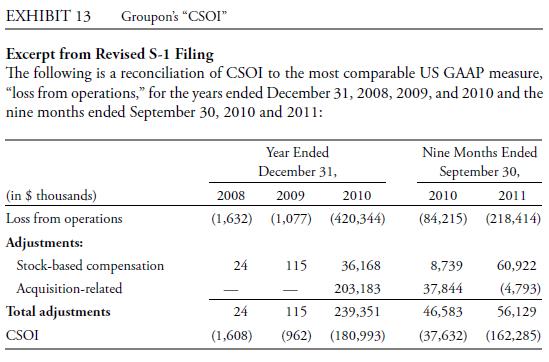

Groupon is an online discount merchant. In the company’s initial S-1 registration statement in 2011, then-CEO Andrew Mason gave prospective investors an up-front warning in a section entitled “We don’t measure ourselves in conventional ways.” He described Groupon’s adjusted consolidated segment operating income (adjusted CSOI) measure. Exhibit 11 provides excerpts from a section entitled “Non-GAAP Financial Measures,” which offered a more detailed explanation of the measure. Exhibit 12 , also from the initial registration statement, shows a reconciliation of CSOI to the most comparable US GAAP measure. In its review, the SEC took the position that online marketing expenses were a recurring cost of business. Groupon responded that the marketing costs were similar to acquisition costs, not recurring costs, and that “we’ll ramp down marketing just as fast as we ramped it up, reducing the customer acquisition part of our marketing expenses” as time passes. 20 Eventually, and after much negative publicity, Groupon changed its non-GAAP measure. Exhibit 13 shows an excerpt from the final prospectus fi led in November, after the SEC’s review. Use the three exhibits to answer the questions that follow.

Because of these limitations, Adjusted CSOI should not be considered as a measure of discretionary cash available to us to invest in the growth of our business. When evaluating our performance, you should consider Adjusted CSOI alongside other financial performance measures, including various cash flow metrics, net loss and our other GAAP results.

1. What cautions did Groupon include along with its description of the “Adjusted CSOI” metric?

2. Groupon excludes “online marketing” from “Adjusted CSOI.” How does the exclusion of this expense compare with the SEC’s limits on non-GAAP performance measures?

3. In the first quarter of 2011, what was the effect of excluding online marketing expenses on the calculation of “Adjusted CSOI”?

4. For 2010, how did results under the revised non-GAAP metric compare with the originally reported metric?

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie