An analyst is evaluating the capital structure of two (hypothetical) companies, Koller Semiconductor and MacRae Manufacturing, as

Question:

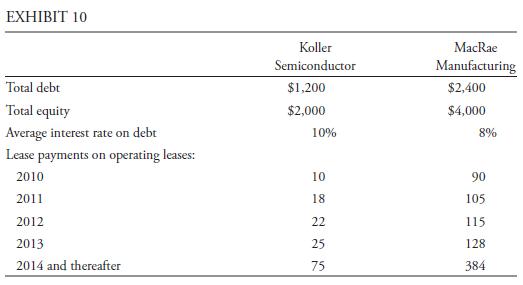

An analyst is evaluating the capital structure of two (hypothetical) companies, Koller Semiconductor and MacRae Manufacturing, as of the beginning of 2010. Koller Semiconductor makes somewhat less use of operating leases than MacRae Manufacturing.

The analyst has the additional information in Exhibit 10 .

Based on the information given in Exhibit 10 and assuming no adjustment to equity, discuss how adjusting for operating leases affects the companies’ solvency on the basis of debt/debt-plus-equity. (Assume payments after 2013 occur at the same rate as for 2013. For example, for Koller Semiconductor, the payments for 2014 through 2016 would be assumed to be $25 each year.)

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie