An analyst observes the following data for two companies: Which of the following choices best describes reasonable

Question:

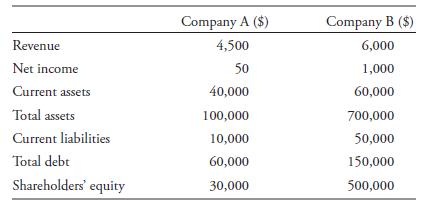

An analyst observes the following data for two companies:

Which of the following choices best describes reasonable conclusions that the analyst might make about the two companies’ abilities to pay their current and long-term obligations?

A. Company A’s current ratio of 4.0 indicates it is more liquid than Company B, whose current ratio is only 1.2, but Company B is more solvent, as indicated by its lower debt-to-equity ratio.

B. Company A’s current ratio of 0.25 indicates it is less liquid than Company B, whose current ratio is 0.83, and Company A is also less solvent, as indicated by a debt-to equity ratio of 200 percent compared with Company B’s debt-to-equity ratio of only 30 percent.

C. Company A’s current ratio of 4.0 indicates it is more liquid than Company B, whose current ratio is only 1.2, and Company A is also more solvent, as indicated by a debt-to-equity ratio of 200 percent compared with Company B’s debt-to-equity ratio of only 30 percent.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie