Apple Inc. (NASDAQ: AAPL) is a company that has evolved and adapted over time. In its 1994

Question:

Apple Inc. (NASDAQ: AAPL) is a company that has evolved and adapted over time.

In its 1994 Prospectus (Form 424B5) fi led with the US SEC, Apple identified itself as “one of the world’s leading personal computer technology companies.” At that time, most of its revenue was generated by computer sales. In the prospectus, however, Apple stated, “The Company’s strategy is to expand its market share in the personal computing industry while developing and expanding into new related business such as Personal Interactive Electronics and Apple Business Systems.” Over time, products other than computers became significant generators of revenue and profit. In its 2010 Annual Report (Form 10-K) filed with the SEC, Apple stated in Part I, Item 1, under Business Strategy,

“The Company is committed to bringing the best user experience to its customers through its innovative hardware, software, peripherals, services, and Internet offerings.

The Company’s business strategy leverages its unique ability to design and develop . . . to provide its customers new products and solutions with superior ease-of-use, seamless integration, and innovative industrial design. . . . The Company is therefore uniquely positioned to offer superior and well-integrated digital lifestyle and productivity solutions.” Clearly, the company is no longer simply a personal computer technology company.

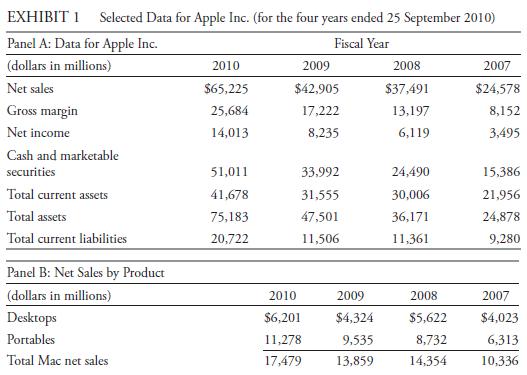

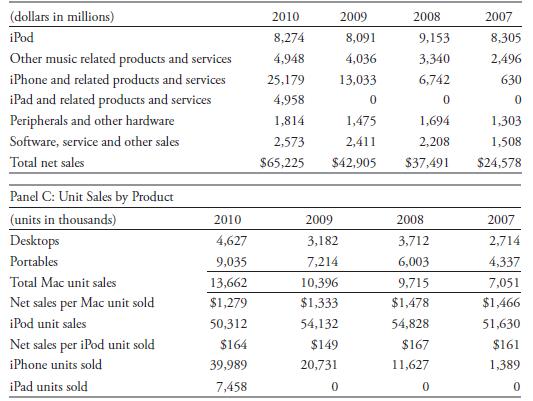

In analyzing the historical performance of Apple as of the beginning of 2011, an analyst might refer to the information presented in Exhibit 1 . Panel A presents selected financial data for the company from 2007 to 2010. Panels B and C present excerpts from the segment footnote. Panel B reports the net sales by product, in millions of dollars, and Panel C reports the unit sales by product, in thousands. [Because Apple manages its business on the basis of geographical segments, the more complete data required in segment reporting (i.e., segment operating income and segment assets) is available only by geographical segment, not by product.]

In 2005, an article in Barron’s said, “In the last year, the iPod has become Apple’s best-selling product, bringing in a third of revenues for the Cupertino, Calif. fi rm. . . .

Little noticed by these iPod zealots, however is a looming threat. . . . Wireless phone companies are teaming up with the music industry to make most mobile phones into music players” ( Barron’s 27 June 2005, p. 19). The threat noted by Barron’s was not unnoticed or ignored by Apple.

In June 2007, Apple itself entered the mobile phone market with the launch of the original iPhone, followed in June 2008 by the second-generation iPhone 3G (a handheld device combining the features of a mobile phone, an iPod, and an internet connection device). Soon after, the company launched the iTunes App Store, which allows users to download third-party applications onto their iPhones. As noted in a 2009 Business Week article, Apple “is the world’s largest music distributor, having passed Wal-Mart Stores in early 2008. Apple sells around 90% of song downloads and 75% of digital music players in the United States” ( Business Week , 28 September 2009, p. 34). Product innovations continue as evidenced by the introduction of the iPad in January 2010.

Using the information provided, address the following:

1. Typically, products that are differentiated either through recognizable brand names, proprietary technology, unique styling, or some combination of these features can be sold at a higher price than commodity products.

A. In general, would the selling prices of differentiated products be more directly reflected in a company’s operating profit margin or gross profit margin?

B. Does Apple’s financial data (Panel A) reflect a successful differentiation strategy?

2. How liquid is Apple at the end of fiscal 2009 and 2010? In general, what are some of the considerations that a company makes in managing its liquidity?

3. Based on the product segment data for 2007 (Panels B and C), Apple’s primary source of revenue was from sales of computers (the $10,336 million in sales of Mac computers represented 42 percent of total net sales) and its secondary source of revenue was from iPods. How has the company’s product mix changed since 2007, and what might this change suggest for an analyst examining Apple relative to its competitors?

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie