Caterpillar Inc. (NYSE: CAT), based in Peoria, Illinois, USA, is the largest maker of construction and mining

Question:

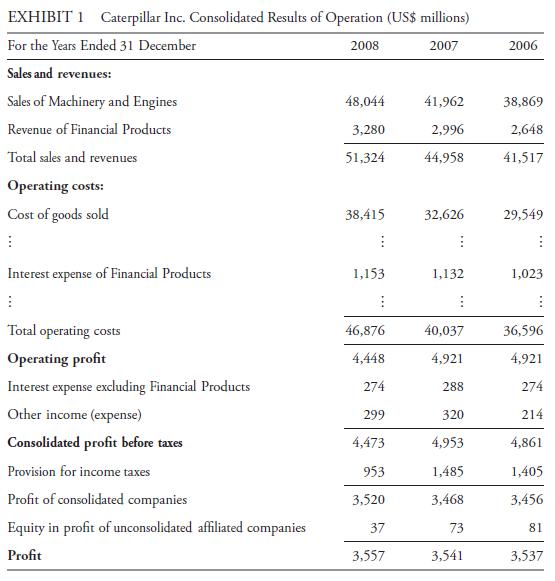

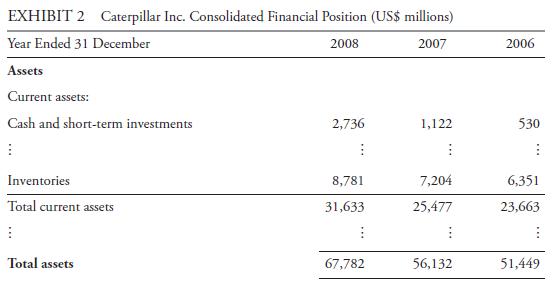

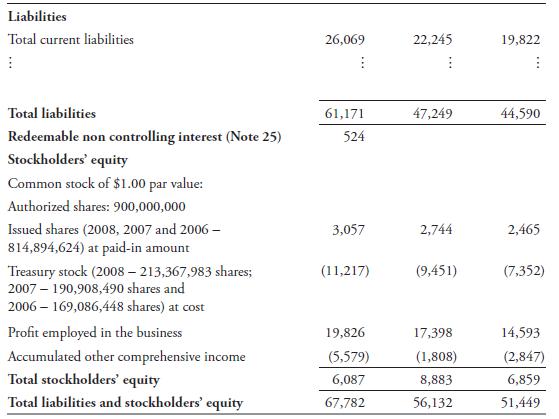

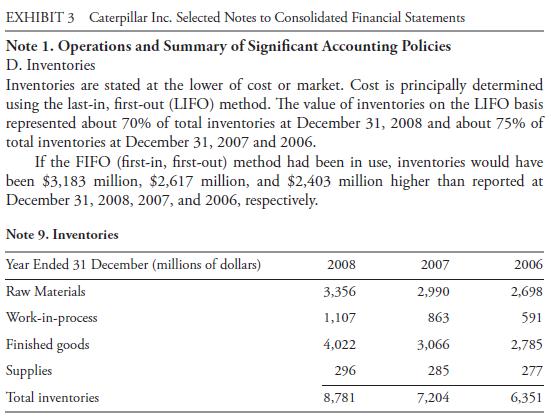

Caterpillar Inc. (NYSE: CAT), based in Peoria, Illinois, USA, is the largest maker of construction and mining equipment, diesel and natural gas engines, and industrial gas turbines in the world. Excerpts from CAT’s consolidated financial statements are shown in Exhibits 1 and 2; notes pertaining to CAT’s inventories are presented in Exhibit 3. Assume tax rates of 20 percent for 2008 and 30 percent for earlier years. The assumed tax rates are based on the provision for taxes as a percentage of consolidated profits before taxes rather than the U.S. corporate statutory tax rate of 35 percent.

1. What inventory values would CAT report for 2008, 2007, and 2006 if it had used the FIFO method instead of the LIFO method?

2. What amount would CAT’s cost of goods sold for 2008 and 2007 be if it had used the FIFO method instead of the LIFO method?

3. What net income (profit) would CAT report for 2008 and 2007 if it had used the FIFO method instead of the LIFO method?

4. By what amount would CAT’s 2008 and 2007 net cash flow from operating activities decline if CAT used the FIFO method instead of the LIFO method?

5. What is the cumulative amount of income tax savings that CAT has generated through 2008 by using the LIFO method instead of the FIFO method?

6. What amount would be added to CAT’s retained earnings (profit employed in the business) at 31 December 2008 if CAT had used the FIFO method instead of the LIFO method?

7. What would be the change in Cat’s cash balance if CAT had used the FIFO method instead of the LIFO method?

8. Calculate and compare the following for 2008 under the LIFO method and the FIFO method: inventory turnover ratio, days of inventory on hand, gross profit margin, net profit margin, return on assets, current ratio, and total liabilities-to-equity ratio.

We had long-term material purchase obligations of approximately $363 million at December 31, 2008.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie