The Volvo Group (OMX Nordic Exchange: VOLV B), based in Gteborg, Sweden, is a leading supplier of

Question:

The Volvo Group (OMX Nordic Exchange: VOLV B), based in Göteborg, Sweden, is a leading supplier of commercial transport products such as construction equipment, trucks, buses, and drive systems for marine and industrial applications as well as aircraft engine components.

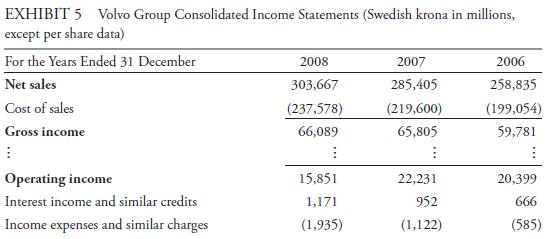

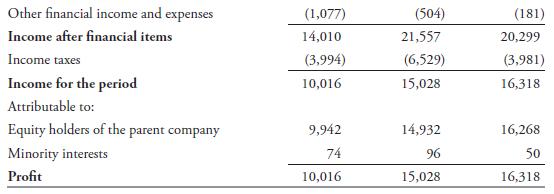

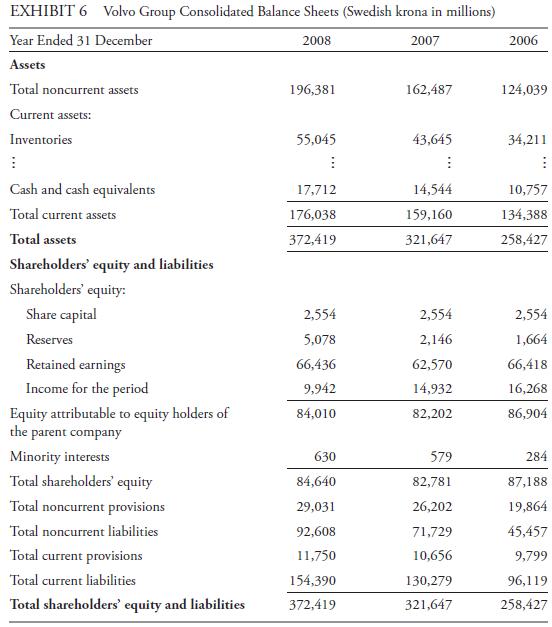

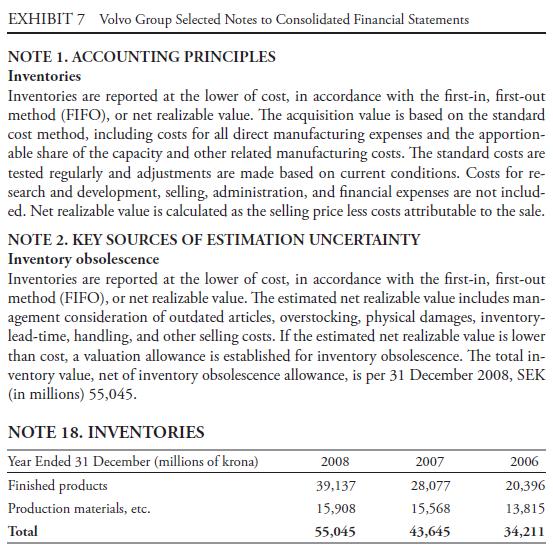

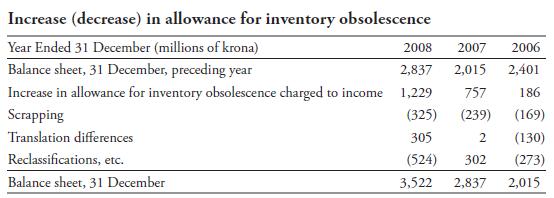

16 Excerpts from Volvo’s consolidated financial statements are shown in Exhibits 5 and 6. Notes pertaining to Volvo’s inventories are presented in Exhibit 7.

1. What inventory values would Volvo have reported for 2008, 2007, and 2006 if it had no allowance for inventory obsolescence?

2. Assuming that any changes to the allowance for inventory obsolescence are reflected in the cost of sales, what amount would Volvo’s cost of sales be for 2008 and 2007 if it had not recorded inventory write-downs in 2008 and 2007?

3. What amount would Volvo’s profit (net income) be for 2008 and 2007 if it had not recorded inventory write-downs in 2008 and 2007? Assume tax rates of 28.5 percent for 2008 and 30 percent for 2007.

4. What would Volvo’s 2008 profit (net income) have been if it had reversed all past inventory write-downs in 2008? Th is question is independent of 1, 2, and 3. Assume a tax rate of 28.5 percent for 2008.

5. Compare the following for 2008 based on the numbers as reported and those assuming no allowance for inventory obsolescence as in questions 1, 2, and 3: inventory turnover ratio, days of inventory on hand, gross profit margin, and net profit margin.

6. CAT has no disclosures indicative of either inventory write-downs or a cumulative allowance for inventory obsolescence in its 2008 financial statements.

Provide a conceptual explanation as to why Volvo incurred inventory write-downs for 2008 but CAT did not.

Step by Step Answer:

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie