The $357,000 adjustment in 2007 most likely resulted in: A. an increase in deferred tax assets. B.

Question:

The $357,000 adjustment in 2007 most likely resulted in:

A. an increase in deferred tax assets.

B. an increase in deferred tax liabilities.

C. no change to deferred tax assets and liabilities.

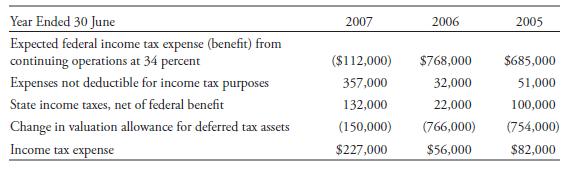

A company’s provision for income taxes resulted in effective tax rates attributable to loss from continuing operations before cumulative effect of change in accounting principles that varied from the statutory federal income tax rate of 34 percent, as summarized in the table below.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

International Financial Statement Analysis CFA Institute Investment Series

ISBN: 9780470287668

1st Edition

Authors: Thomas R. Robinson, Hennie Van Greuning CFA, Elaine Henry, Michael A. Broihahn, Sir David Tweedie

Question Posted: