A bond portfolio consists of the following three fixed-rate bonds. Assume annual coupon payments and no accrued

Question:

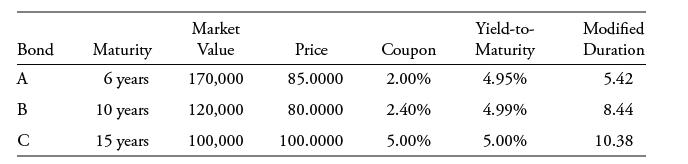

A bond portfolio consists of the following three fixed-rate bonds. Assume annual coupon payments and no accrued interest on the bonds. Prices are per 100 of par value.

The bond portfolio’s modified duration is closest to:

A. 7.62.

B. 8.08.

C. 8.20.

Transcribed Image Text:

Bond Maturity 6 years 10 years 15 years A B C Market Value 170,000 120,000 100,000 Price 85.0000 80.0000 100.0000 Coupon 2.00% 2.40% 5.00% Yield-to- Maturity 4.95% 4.99% 5.00% Modified Duration: 5.42 8.44 10.38

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

To calculate the bond portfolios modified durationwe need to first calculate the market valueweighte...View the full answer

Answered By

Gauri Hendre

I worked as EI educator for Eduphy India YT channel. I gave online tutorials to the students who were living in the villages and wanted to study much more and were preparing for NEET, TET. I gave tutions for topics in Biotechnology. I am currently working as a tutor on course hero for the biochemistry, microbiology, biology, cell biology, genetics subjects. I worked as a project intern in BAIF where did analysis on diseases mainly genetic disorders in the bovine. I worked as a trainee in serum institute of India and Vasantdada sugar institute. I am working as a writer on Quora partner program from 2019. I writing on the topics on social health issues including current COVID-19 pandemic, different concepts in science discipline. I learned foreign languages such as german and french upto A1 level. I attended different conferences in the science discipline and did trainings in cognitive skills and personality development skills from Lila Poonawalla foundation. I have been the member of Lila poonawalla foundation since 2017. Even I acquired the skills like Excel spreadsheet, MS Office, MS Powerpoint and Data entry.

5.00+

4+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

In problem, use a calculator to evaluate each expression. Round your answer to three decimal places. + log 20 log 15 In 15 + In 20

-

Discuss the definition of organizational culture and describe four important characteristics of the organizational cultures identified in your text. Discuss the various factors that influence the...

-

Organisations can have strong or weak cultures. Answer the following questions about organisational culture, and provide example(s). (2% for each question) a)Which is more beneficial to an...

-

In Problem, find the indicated derivative. Find y (5) if d 2 y/dx 2 = 3 3x + 2.

-

When making an estimate for the time and cost to execute a project, should the time and cost required to develop the planning, monitoring, and controlling systems be included as well? Should the...

-

Propose structures for amines with the following 1H NMR spectra: (a) C3H9NO (b)C4H11NO2 TMS O ppm 10 6. Chemical shift (8) TMS O ppm 10 7. 9. Chemical shift (8) Intensity Intensity -3-

-

Deanna Golds started an interior design company called Interiors by Deanna, Inc., on November 1,2010. The following amounts summarize the financial position of her business on November 14, 2010,...

-

Gerstner Corporation is authorized to issue 10,000 shares of $40 par value, 10% preferred stock and 200,000 shares of $5 par value common stock . On January 1, 2014, the ledger contained the...

-

It's no surprise that Google has topped the list of Fortune 100's " Best Companies to Work for " yet again this year for a grand total of four times. Their jaw-dropping company campus Googleplex is...

-

Assuming no change in the credit risk of a bond, the presence of an embedded put option: A. Reduces the effective duration of the bond. B. Increases the effective duration of the bond. C. Does not...

-

Which of the following statements about Macaulay duration is correct? A. A bonds coupon rate and Macaulay duration are positively related. B. A bonds Macaulay duration is inversely related to its...

-

Draw up a consolidated balance sheet from the following balance sheets which were drawn up as soon as Papai Ltd had acquired control of Sonny Jim Ltd. Papai Balance Sheet Investment in Sonny Jim Ltd:...

-

What is the total flux of the electric field E = cyk through the rectangular surface shown in Figure? dy

-

Variable costs and fixed costs. Consolidated Minerals (CM) owns the rights to extract minerals from the beach sands on Fraser Island. CM has costs in three areas: a) Payment to a mining subcontractor...

-

In an environment of extreme volatility, the central bank of a country (e.g., Bank of England) can take different measures to intervene in the foreign exchange market. Define those intervention...

-

Malkovich Company uses a standard costing system. The following information pertains to direct materials for the month of July: Standard price per lb. $18.00 Actual purchase price per lb. $16.50...

-

Dave Derelict puts on a suit and tie and ventures into a neighborhood to represent himself as a city building inspector. He knocks on the front doors of different homes and tells residents that he is...

-

What two first-row transition metals have unexpected electron configurations? A statement in the text says that first-row transition metal ions do not have 4s electrons. Why not? Why do transition...

-

9.Consider the reaction 3NO2(g)+H2O=2HNO3(aq)+NO(g) where Delta H=-137 kJ.How many kilojoules are released when 92.3g of NO2 reacts?

-

You have $100,000 to invest in a portfolio containing Stock X and Stock Y. Your goal is to create a portfolio that has an expected return of 11.7 percent. If Stock X has an expected return of 10.8...

-

Based on the following information, calculate the expected return and standard deviation of each of the following stocks. Assume each state of the economy is equally likely to happen. What are the...

-

Based on the following information, calculate the expected return and standard deviation for each of the following stocks. What are the co-variance and correlation between the returns of the two...

-

Come-Clean Corporation produces a variety of cleaning compounds and solutions for both industrial and household use. While most of its products are processed independently, a few are related, such as...

-

3. A carwash employs workers on daily price-rate basis for their weekly work. There are five worker and their charges and speed are different (Table 1). According to an earlier understanding only one...

-

Salazar Electronics Corporation makes cell phones. Their records for the month of March are as follows: Sales 1,600 units at $500 per unit: $800,000 Variable Costs 1,600 units at $300 per unit:...

Study smarter with the SolutionInn App