A Sydney-based fixed-income portfolio manager is considering the following Commonwealth of Australia government bonds traded on the

Question:

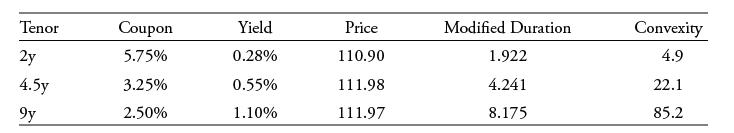

A Sydney-based fixed-income portfolio manager is considering the following Commonwealth of Australia government bonds traded on the ASX (Australian Stock Exchange):

The manager is considering portfolio strategies based upon various interest rate scenarios over the next 12 months. She is considering three long-only government bond portfolio alternatives, as follows:

Bullet: Invest solely in 4.5-year government bonds

Barbell: Invest equally in 2-year and 9-year government bonds

Equal weights: Invest equally in 2-year, 4.5-year, and 9-year bonds

If the manager has a positive butterfly view on Australian government yields-to-maturity, the best portfolio position strategy to pursue is to:

A. Purchase the bullet portfolio and sell the barbell portfolio.

B. Sell the bullet portfolio and sell the barbell portfolio.

C. Purchase the equally weighted portfolio and sell the barbell portfolio.

Step by Step Answer: