A US-based portfolio manager plans to invest in Australian zero-coupon bonds denominated in Australian dollars (AUD). He

Question:

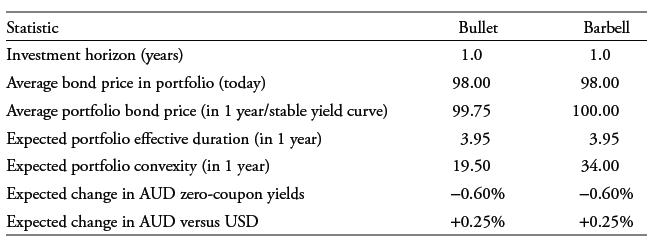

A US-based portfolio manager plans to invest in Australian zero-coupon bonds denominated in Australian dollars (AUD). He projects that over the next 12 months, the Australian zero-coupon yield curve will experience a downward parallel shift of 60 bps and that AUD will appreciate 0.25% against USD. The manager is weighing bullet and barbell strategies using the following data:

Solve for the expected return over the 1-year investment horizon for each portfolio using the step-by-step estimation approach in Equation 1.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: