Assume a 1-year investment horizon for a portfolio manager considering US Treasury market strategies. The manager is

Question:

Assume a 1-year investment horizon for a portfolio manager considering US Treasury market strategies. The manager is considering two strategies to capitalize on an expected rise in US Treasury security zero-coupon yield levels of 50 bps in the next 12 months:

1. A bullet portfolio fully invested in 5-year zero-coupon notes currently priced at 94.5392.

2. A barbell portfolio: 62.97% is invested in 2-year zero-coupon notes priced at 98.7816, and 37.03% is invested in 10-year zero-coupon bonds priced at 83.7906.

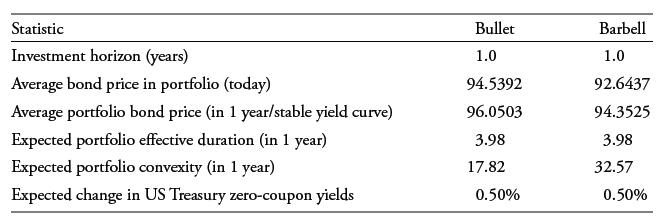

Further assumptions for evaluating these portfolios are shown here:

Solve for the expected return over the 1-year investment horizon for each portfolio using the step-by-step estimation approach in Equation 1.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: