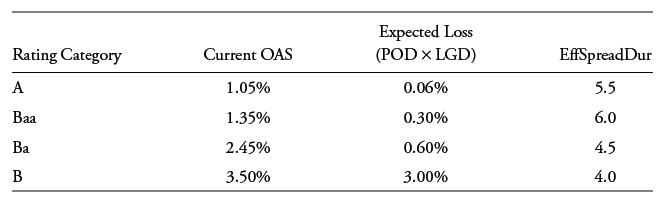

An active credit portfolio manager considers the following corporate bond portfolio choices familiar from an earlier example:

Question:

An active credit portfolio manager considers the following corporate bond portfolio choices familiar from an earlier example:

The investor anticipates an economic slowdown in the next year that will have a greater adverse impact on lower-rated issuers. Assume that an index portfolio is equally allocated across all four rating categories, while the investor chooses a tactical portfolio combining equal long positions in the investment-grade (A and Baa) bonds and short positions in the high-yield (Ba and B) bonds.

Calculate excess spread on the index and tactical portfolios assuming no change in spreads over the next year (ignoring spread duration changes).

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: