Consider the information from the bank and government annual coupon bonds from the prior example: Assuming that

Question:

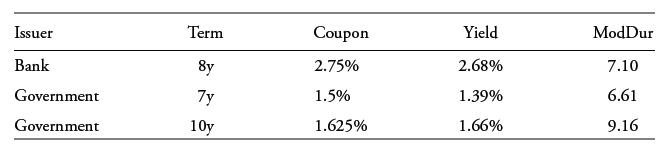

Consider the information from the bank and government annual coupon bonds from the prior example:

Assuming that 7- and 10-year swap spreads over the respective government benchmark yields to maturity are 15 bps and 20 bps, calculate the ASW and the I-spread for the bank bond, and interpret the difference between the two.

Transcribed Image Text:

Issuer Bank Government Government Term 8y 7y 10y Coupon 2.75% 1.5% 1.625% Yield 2.68% 1.39% 1.66% ModDur 7.10 6.61 9.16

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

1 Solve for the weights of the 7year and the 10year bond in the interpolation calculation ...View the full answer

Answered By

Somshukla Chakraborty

I have a teaching experience of more than 4 years by now in diverse subjects like History,Geography,Political Science,Sociology,Business Enterprise,Economics,Environmental Management etc.I teach students from classes 9-12 and undergraduate students.I boards I handle are IB,IGCSE, state boards,ICSE, CBSE.I am passionate about teaching.Full satisfaction of the students is my main goal.

I have completed my graduation and master's in history from Jadavpur University Kolkata,India in 2012 and I have completed my B.Ed from the same University in 2013. I have taught in a reputed school of Kolkata (subjects-History,Geography,Civics,Political Science) from 2014-2016.I worked as a guest lecturer of history in a college of Kolkata for 2 years teaching students of 1st ,2nd and 3rd year. I taught Ancient and Modern Indian history there.I have taught in another school in Mohali,Punjab teaching students from classes 9-12.Presently I am working as an online tutor with concept tutors,Bangalore,India(Carve Niche Pvt.Ltd.) for the last 1year and also have been appointed as an online history tutor by Course Hero(California,U.S) and Vidyalai.com(Chennai,India).

4.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

KYC's stock price can go up by 15 percent every year, or down by 10 percent. Both outcomes are equally likely. The risk free rate is 5 percent, and the current stock price of KYC is 100. (a) Price a...

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

1) The mast on the boat is held in place by the rigging, which consists of rope having a diameter of 25 mm and a total length of 50m. Assuming the rope to be cylindrical, determine the drag it exerts...

-

Assume that Nike decides to build a shoe factory in Brazil; half the initial outlay will be funded by the parents equity and half by borrowing funds in Brazil. Assume that Nike wants to assess the...

-

Assume that an iPhone currently sells for 200 and at this quantity, 10 million units are purchased. The price now falls to 170. If the price elasticity of demand (using the formula: percentage change...

-

Is there a single standard command-line processor to parse and process argv?

-

Budgeted income statement. (CMA, adapted) Easecom Company is a manufacturer of videoconferencing products. Regular units are manufactured to meet marketing projections, and specialized units are made...

-

When discussing possible purchase of a fixed immediate annuity, not discussing the full range of available annuitization options and the implications of choosing one over another, particularly with...

-

An active United Statesbased credit manager is offered similar US corporate bond portfolio choices to those in an earlier example: As in the earlier case, the manager expects an economic rebound but...

-

An active credit portfolio manager considers the following corporate bond portfolio choices familiar from an earlier example: The investor anticipates an economic slowdown in the next year that will...

-

A talk on the dangers of high cholesterol was given to eight workers. Each workers cholesterol was tested both before the talk and several weeks after the talk, with the results given below. What is...

-

In the figure below, determine the point (other than infinity) at which the electric field is zero. (Let q = -2.20 C and 92 = 6.80 C.) m to the left of q1 Need Help? 91 Master It -1.00 m- 92

-

We have a waveform with a pulse duration of 2 us and a listening time of 8 us . What would be the pulse repetition frequency?

-

Solve the initial value problem. y!!+8y/+15y = 0, y(0)= 0, y(0) = 1 Oy(t) =ete5t Oy(t) =est - 2t 5t 1 e Oy(t) =e 5te3t 1 1 y(t) = e-te5t

-

A 5 1 - kg woman eats a 5 7 1 Calorie ( 5 7 1 kcal ) jelly doughnut for breakfast. ( a ) How many joules of energy are the equivalent of one jelly doughnut? J ( b ) How many steps must the woman...

-

Consider a flow of liquid with constant flow rate passes through the cross section of pipe (figure attached below), predict the nature of the flow with respect to the observer. Section A1 Section A2...

-

Mike Ackerman decided to open Mikes Nail Spa. Mike completed the following transactions: a. Invested $24,000 cash from his personal bank account into the business. b. Bought store equipment for cash,...

-

What are some of the various ways to implement an awareness program?

-

Under what circumstances might a corporation elect not to carry back an NOL to its prior tax years?

-

What conditions must be met for an accrual-basis corporation to deduct a charitable contribution in a year before it is made?

-

Acorn Corporation is publicly traded on the American Stock Exchange. Its chief executive officer, Carl, currently receives an annual salary of $1 million. The board of directors is considering...

-

Microtubules are filamentous structures in cells that maintain cell shape and facilitate the movement of molecules within the cell. They are long, hollow cylinders with a diameter of about 25 nm. It...

-

3. The offshore design group at Bechtel just purchased upgraded CAD software for $5000 now and annual payments of $500 per year for 6 years starting 3 years from now for annual upgrades. What is the...

-

Module 6: Week 6 Introduction Overview This module discusses the role of international cooperation and international law in providing peace and security in the international system. You will also...

Study smarter with the SolutionInn App