An active United Statesbased credit manager faces the following US and European investment-grade and high-yield corporate bond

Question:

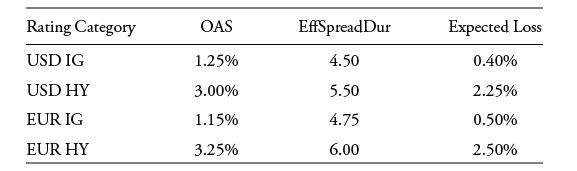

An active United States–based credit manager faces the following US and European investment-grade and high-yield corporate bond portfolio choices:

The EUR IG and EUR HY allocations are denominated in euros, and the euro is expected to depreciate by 2% versus the US dollar over the next year.

What is the approximate unhedged excess return to the United States–based credit manager for an international credit portfolio index equally weighted across the four portfolio choices, assuming no change to spread duration and no default losses occur?

A. −0.257%

B. −0.850%

C. 0.750%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: