An investor considers the purchase of a two-year bond with a 5% coupon rate, with interest paid

Question:

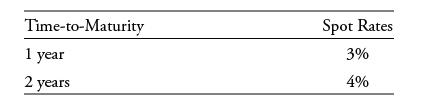

An investor considers the purchase of a two-year bond with a 5% coupon rate, with interest paid annually. Assuming the sequence of spot rates shown below, the price of the bond is closest to:

A. 101.93.

B. 102.85.

C. 105.81.

Transcribed Image Text:

Time-to-Maturity 1 year 2 years Spot Rates 3% 4%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (4 reviews)

The price of a bond can be calculated using the present value of its future c...View the full answer

Answered By

Nimlord Kingori

2023 is my 7th year in academic writing, I have grown to be that tutor who will help raise your grade and better your GPA. At a fraction of the cost on other sites, I will work on your assignment by taking it as mine. I give it all the attention it deserves and ensures you get the grade that I promise. I am well versed in business-related subjects, information technology, Nursing, history, poetry, and statistics. Some software's that I have access to are SPSS and NVIVO. I kindly encourage you to try me; I may be all that you have been seeking, thank you.

4.90+

360+ Reviews

1070+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Managing Scope Changes Case Study Scope changes on a project can occur regardless of how well the project is planned or executed. Scope changes can be the result of something that was omitted during...

-

Polygamy is a term covering? (a) Levirate and sororate (b) Endogamy and exogamy (c) Polygyny and polyandry (d) Cross cousin marriage and parallel cousin marriage

-

A pension fund manager anticipates the purchase of a 20-year, 8 percent coupon Treasury bond at the end of two years. Interest rates are assumed to change only once every year at year-end, with an...

-

Read the Speech of Martin Luther King, Jr.'s "I Have a Dream" and answer the question: Kin, makes liberal use of metaphorand metaphorical imagery in his speech. (Glossary: Figures of Speech) Choose a...

-

The Coca-Cola Company (Coca-Cola), like PepsiCo, manufactures and markets a variety of beverages. Exhibit 3.22 presents a statement of cash flows for Coca-Cola for 2006 to 2008. Required Discuss the...

-

A cross-sectional view is shown of the skyways in the Kansas City Hyatt Regency hotel in their as-constructed form, along with the forces acting on the nuts and washers that contact the two walkways...

-

The annual profits (in thousands of dollars) of a sample of 27 companies listed on a stock exchange Use technology to draw a box-and-whisker plot that represents the data set. 12.86 51.11 13.84 15.96...

-

A survey of 545 college students asked: What is your favorite winter sport? And, what type of college do you attend? The results are summarized below: Using these 545 students as the sample, a...

-

Read the passage below. Based on your reading assignment, please answer the two-tiered question below. Incorporate your academic opinion, which should be supported by your research findings rather a...

-

The following information relates All three bonds pay interest annually. Based on the given sequence of spot rates, the price of Bond X is closest to: A. 95.02. B. 95.28. C. 97.63. Bond Coupon Rate X...

-

Suppose a bonds price is expected to increase by 5% if its market discount rate decreases by 100 bps. If the bonds market discount rate increases by 100 bps, the bond price is most likely to change...

-

In Problems, use a graphing calculator to (a) Approximate two x-intercepts of the graph of the function (to four decimal places) and (b) Give the approximate zeros of the function. y = x 2 - 7x - 9

-

A boat leaves a dock and travels at an average rate of 15 kilometers per hour. Another boat leaves 45 minutes later and travels the same route at an average speed of 24 kilometers per hour. In how...

-

Find f'(2) for f(x) = ln(4x-6). f'(-2)= Preview

-

A parachutist's rate during a free fall reaches 70 meters per second. What is this rate in feet per second? At this rate, how many feet will the parachutis during 15 seconds of free fall? In your...

-

Assets $ Liabilities $ Current Assets Current Liabilities Cash 12,000 Accounts payable 28,500 Cash at bank 7,000 Wages payable 7,000 Accounts receivable 35,000 Taxes payable 12,000 Inventory 30,500...

-

Pool Plans The total length is between 10 and 16 feet. The width is between 6 and 8 feet. The deepest part of the pool is no more than 4 feet deep. The total volume is 300 cubic feet or less. What...

-

Dyggur Equipment manufactures and sells heavy equipment used in construction and mining. Customers are contractors who want reliable equipment at a low cost. The firms strategy is to provide reliable...

-

Find i 0 (t) for t > 0 in the circuit in Fig. 16.72 . 2 + Vo 1 7.5e-2t u(t) V ( +) 4.5[1 u(t)]V 0.5v. 1H

-

Distinguish between one-price and flexible-price policies. Which is most appropriate for a hardware store? Why?

-

What pricing objective( s ) is a skimming pricing policy most likely implementing? Is the same true for a penetration pricing policy? Which policy is probably most appropriate for each of the fo...

-

How would differences in exchange rates between different countries affect a firms decisions concerning the use of flexible-price policies in different foreign markets?

-

Fixed point f L A one-dimensional line consists of N number of asymmetric molecules. Consider that the molecules can exchange places with each other laterally. One may think that this would not be...

-

OK. NEW SET OF SCENARIOS. Let's pretend that you started the period with some inventory - 2 million clips that were 40% complete. So, you had to finish them this period. Then you started 10 million...

-

A modified Carnot's cycle is shown in the above figure. Isotherm (T) Isotherm (T2) Isotherm (T3) 1. Show the corresponding Temperature-Entropy diagram 10 pts 2. Estimate dF for this system showing...

Study smarter with the SolutionInn App