Chaopraya is an investment advisor for high-net-worth individuals. One of her clients, Schuylkill, plans to fund her

Question:

Chaopraya is an investment advisor for high-net-worth individuals. One of her clients, Schuylkill, plans to fund her grandson’s college education and considers two options:

• Option 1: Contribute a lump sum of $300,000 in 10 years.

• Option 2: Contribute four level annual payments of $76,500 starting in 10 years.

The grandson will start college in 10 years. Schuylkill seeks to immunize the contribution today.

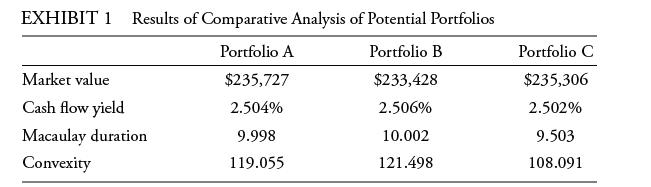

For Option 1, Chaopraya calculates the present value of the $300,000 as $234,535. To immunize the future single outflow, Chaopraya considers three bond portfolios given that no zero-coupon government bonds are available. The three portfolios consist of non-callable, fixed-rate, coupon-bearing government bonds considered free of default risk. Chaopraya prepares a comparative analysis of the three portfolios, presented in Exhibit 1.

Chaopraya evaluates the three bond portfolios and selects one to recommend to Schuylkill.

Step by Step Answer: