Manuel Perello is a wealth manager for several Latin American families who seek to keep a portion

Question:

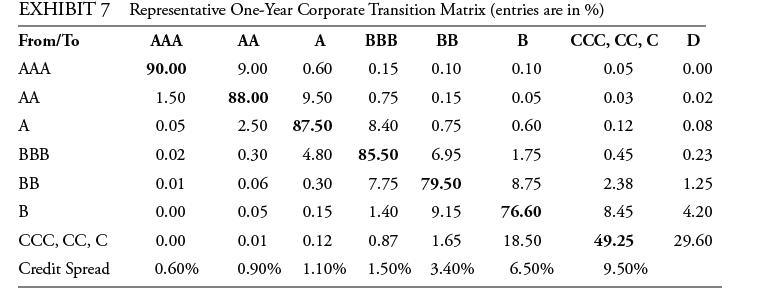

Manuel Perello is a wealth manager for several Latin American families who seek to keep a portion of their assets in very high-quality corporate bonds. Mr. Perello explains that the yields to maturity on the bonds should be adjusted for possible credit spread widening to measure the expected rate of return over a given time horizon. In his presentation to one of the families, he uses a 10-year, AAA rated corporate bond that would have a modified duration of 7.3 at the end of the year. Using the corporate transition matrix in Exhibit 7, Mr. Perello concludes that the expected return on the bond over the next year can be approximated by the yield to maturity less 32.5 bps to account for a possible credit downgrade even if there is no default. Demonstrate how he arrives at that conclusion.

Step by Step Answer: