On 1 January 20X2, Deem Advisors purchased a $10 million six-year senior unsecured bond issued by UNAB

Question:

On 1 January 20X2, Deem Advisors purchased a $10 million six-year senior unsecured bond issued by UNAB Corporation. Six months later (1 July 20X2), concerned about the portfolio’s credit exposure to UNAB, Doris Morrison, the chief investment officer at Deem Advisors, buys $10 million protection on UNAB with a standardized coupon rate of 5%. The reference obligation of the CDS is the UNAB bond owned by Deem Advisors. UNAB adheres to the ISDA CDS protocols.

On 1 January 20X3, Morrison asks Bill Watt, a derivatives analyst, to assess the current credit quality of UNAB bonds and the value of Deem Advisors’ CDS on UNAB debt. Watt gathers the following information on UNAB’s debt issues currently trading in the market:

Bond 1: A two-year senior unsecured bond trading at 40% of par

Bond 2: A five-year senior unsecured bond trading at 50% of par

Bond 3: A five-year subordinated unsecured bond trading at 20% of par

With respect to the credit quality of UNAB, Watt makes the following statement:

“There is severe near-term stress in the financial markets, and UNAB’s credit curve clearly reflects the difficult environment.”

On 1 July 20X3, UNAB fails to make a scheduled interest payment on the outstanding subordinated unsecured obligation after a grace period; however, the company does not file for bankruptcy. Morrison asks Watt to determine if UNAB experienced a credit event and, if so, to recommend a settlement preference.

Kand Corporation

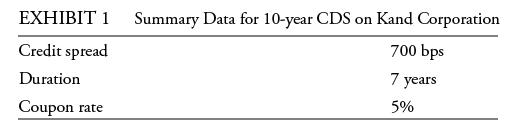

Morrison is considering purchasing protection on Kand Corporation debt to hedge the portfolio’s position in Kand. She instructs Watt to determine if an upfront payment would be required and, if so, the amount of the premium. Watt presents the information for the CDS in Exhibit 1.

Morrison purchases 10-year protection on Kand Corporation debt. Two months later the credit spread for Kand Corporation has increased by 200 bps. Morrison asks Watt to close out the firm’s CDS position on Kand Corporation by entering into a new, offsetting contract.

Tollunt Corporation

Deem Advisors’ chief credit analyst recently reported that Tollunt Corporation’s five-year bond is currently yielding 7% and a comparable CDS contract has a credit spread of 4.25%. Since the current market reference rate is 2.5%, Watt has recommended executing a basis trade to take advantage of the pricing of Tollunt’s bonds and CDS. The basis trade would consist of purchasing both the bond and the CDS contract.

If UNAB experienced a credit event on 1 July, Watt should recommend that Deem Advisors:

A. Prefer a cash settlement.

B. Prefer a physical settlement.

C. Be indifferent between a cash or a physical settlement.

Step by Step Answer: