Say a UK-based manager seeks to extend duration beyond an index by adding 10-year exposure. The manager

Question:

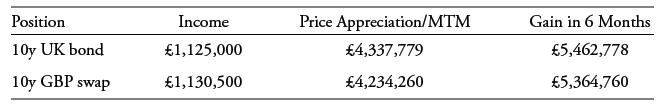

Say a UK-based manager seeks to extend duration beyond an index by adding 10-year exposure. The manager considers either buying and holding a 10-year, 2.25% semi-annual coupon UK government bond priced at ₤93.947, with a corresponding yield-to-maturity of 2.9535%, or entering a new 10-year, GBP receive-fixed interest rate swap at 2.8535% versus the six-month GBP MRR currently set at 0.5925%. We compare the results of both strategies over a six-month time horizon for a ₤100 million par value during which both the bond yield-to-maturity and swap rates fall 50 bps. We ignore day count details in the calculation.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: