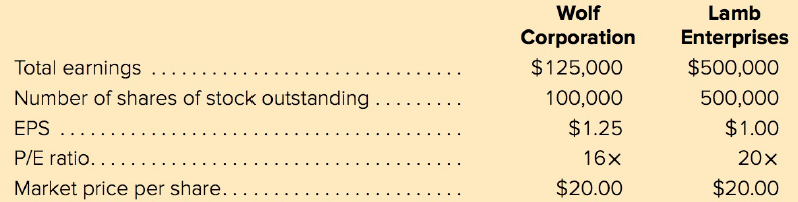

Assume the following financial data for the Wolf Corporation and Lamb Enterprises. a. If all the shares

Question:

a. If all the shares of the Wolf Corporation are exchanged for shares of the Lamb Enterprises on a share-for-share basis, what will post merger EPS be for Lamb Enterprises? Use an approach similar to Table 20-4.

Table 20-4

Total earnings: Small ($200,000) + Expand ($500,000).................. $700,000

Shares outstanding in surviving corporation:

Old (200,000) + New (50,000) ..................................................... . . 250,000

New EPS for Expand Corporation = $700,000/250,000 = $2.80

b. Explain why the EPS of Lamb Enterprises changed.

c. Can we necessarily assume that Lamb Enterprises is better or worse off?

Step by Step Answer:

Foundations of Financial Management

ISBN: 978-1259024979

10th Canadian edition

Authors: Stanley Block, Geoffrey Hirt, Bartley Danielsen, Doug Short, Michael Perretta