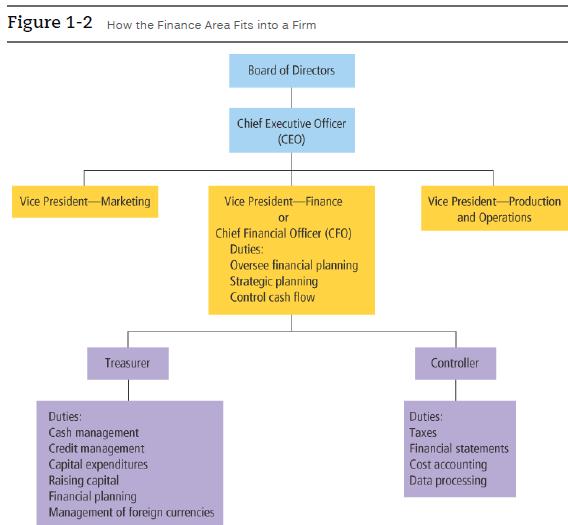

A firm can assume many different organizational structures. Figure 1-2 shows a typical presentation of how the

Question:

A firm can assume many different organizational structures. Figure 1-2 shows a typical presentation of how the finance area fits into a firm. The vice president for finance, also called the chief financial officer (CFO), serves under the firm’s chief executive officer (CEO) and is responsible for overseeing financial planning, strategic planning, and controlling the firm’s cash flow. Typically, a treasurer and controller serve under the CFO. In a smaller firm, the same person may fill both roles, with just one office handling all the duties. The treasurer generally handles the firm’s financial activities, including cash and credit management, making capital expenditure decisions, raising funds, financial planning, and managing any foreign currency received by the firm. The controller is responsible for managing the firm’s accounting duties, including producing financial statements, cost accounting, paying taxes, and gathering and monitoring the data necessary to oversee the firm’s financial well-being. In this textbook, we focus on the duties generally associated with the treasurer and on how investment decisions are made.

Concept Check 1. What are the basic types of issues addressed by the study of finance?

2. What are the duties of a treasurer? Of a controller?

Step by Step Answer:

Foundations Of Finance

ISBN: 9781292318738

10th Global Edition

Authors: Arthur Keown, John Martin, J. Petty