Owners of new businesses have some important decisions to make in choosing an organizational form. Whereas each

Question:

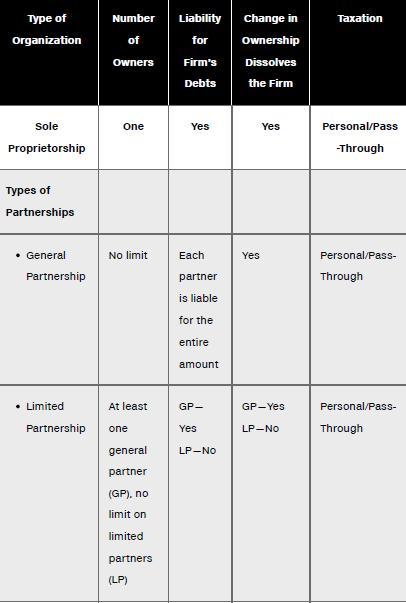

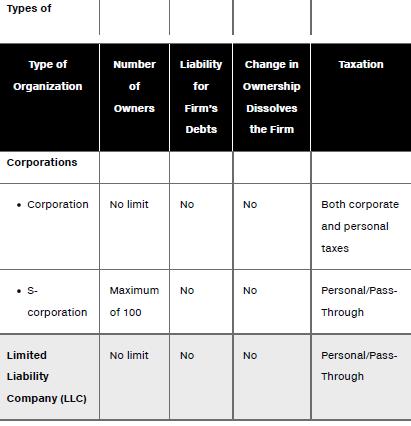

Owners of new businesses have some important decisions to make in choosing an organizational form. Whereas each business form seems to have some advantages over the others, the advantages of the corporation begin to dominate as the firm grows and needs access to the capital markets to raise funds. Table 1-1 provides a summary of the differences among the major organizational forms.

Because of the limited liability, the ease of transferring ownership through the sale of common shares, and the flexibility in dividing the shares, the corporation is the ideal business entity in terms of attracting new capital. In contrast, the unlimited liabilities of the sole proprietorship and the general partnership are deterrents to raising equity capital.

Between the extremes, the limited partnership does provide limited liability for limited partners, which has a tendency to attract wealthy investors. However, the impracticality of having a large number of partners and the restricted marketability of an interest in a partnership prevent this form of organization from competing effectively with the corporation. Therefore, when developing our decision models, we assume we are dealing with the corporate form and corporate tax codes.

Concept Check 1. What are the primary differences among a sole proprietorship, a partnership, and a corporation?

2. Explain why large and growing firms tend to choose the corporate form.

3. What is an LLC?

Step by Step Answer:

Foundations Of Finance

ISBN: 9781292318738

10th Global Edition

Authors: Arthur Keown, John Martin, J. Petty