Osteria Francescana Restaurant has come up with a new fine dining concept restaurant but it is not

Question:

Osteria Francescana Restaurant has come up with a new fine dining concept restaurant but it is not quite sure how the public will react to it.

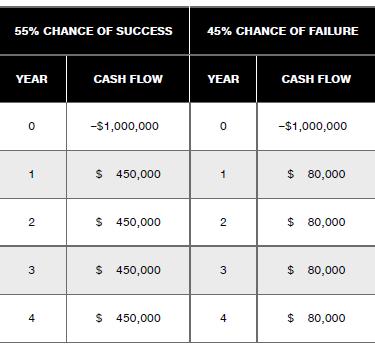

Osteria Francescana feels that there is a 55 percent chance that customers will like it and a 45 percent chance that they won’t.

Osteria Francescana is considering building one of these new restaurants; the cash flows if it succeeds and if it fails are given below:

The required rate of return is 9 percent. What is the NPV of the project if it is successfully received? What is the NPV if it is unsuccessfully received? Now determine the expected NPV from taking on this project given the fact that is has a 55–45 chance of success. If the project is well received by the public, Osteria Francescana expects to build 22 more of these restaurants throughout Europe. The cash flows from these projects will be identical to the cash flows from the successful outcome, with the initial outlay occurring in year 1 rather than year 0 and followed by four annual cash flows of $450,000 each. The one-year delay for the expansion restaurants is a result of the fact that it will take one year to gauge how the public responds to the initial new restaurant. If it is not well received, then the project will be abandoned after year 4. What is the NPV of the project assuming that 22 additional of these restaurants will be built?

Step by Step Answer:

Foundations Of Finance

ISBN: 9781292318738

10th Global Edition

Authors: Arthur Keown, John Martin, J. Petty