Fast Response is a business delivering goods to customers. The following information is available: (1) Extract from

Question:

Fast Response is a business delivering goods to customers. The following information is available:

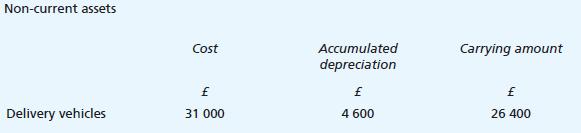

(1) Extract from the Balance Sheet at 31 December 2024.

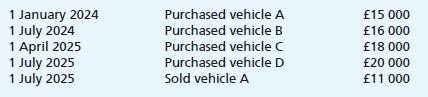

(2) History of delivery vehicle purchases and sales.

(3) Fast Response has the following depreciation policy:

• delivery vehicles are depreciated at the rate of 20% per annum using the straight line method • depreciation is charged on delivery vehicle purchases and sales on a pro rata basis to the months of ownership • all sales of delivery vehicles are recorded through a disposal account.

(4) All purchases and sales of delivery vehicles were by cheque.

Required:

(a) Calculate the depreciation charged on each delivery vehicle for the year ended 31 December 2025.

(b) Prepare the journal entries to record the sale of delivery vehicle A on 1 July 2025.

(c) Prepare, for the year ending 31 December 2025, the:

(i) Delivery Vehicles at cost Account (ii) Delivery Vehicles Disposal Account.

(d) Explain the difference between the accounting concepts of going concern and consistency when applied to the depreciation of non-current assets.

(e) Identify whether each of the following costs is a capital expenditure or a revenue expenditure for a new delivery vehicle purchased.

(1) Delivery cost of vehicle (2) Road licence (3) Insurance (4) Sign writing of business name on delivery vehicle

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood