Please answer the following five questions: (a) Tomaszs business buys and sells various products, including Product J.

Question:

Please answer the following five questions:

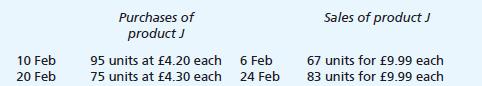

(a) Tomasz’s business buys and sells various products, including Product J. The business has 100 units of J in stock at 1 February valued (using the FIFO assumption) at £4 each. Calculate the value of inventory at the end of February using the FIFO method based on the following information:

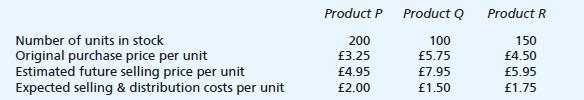

(b) Denise’s business has just three lines of inventory (products P, Q and R) at the end of its financial year:

What should be the value of closing inventory in Denise’s financial statements?

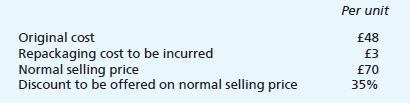

(c) Emily runs a wholesaling business. She has decided to repackage one of her least popular products in new boxes and offer a discount on the selling price. Details of the product are:

At what amount should each unit be included in Emily’s inventory?

(d) Farhad is a wholesaler of sports equipment. The closing inventory of the business as at 31 August amounted to £365,700 at cost. The following items were included at cost in this total:

(i) 300 tennis rackets which had cost £50 each and normally sell for £90. However, owing to minor defects they were sold on 19 September at 50% of their normal price. Selling expenses were incurred which amounted to £2 per racket.

(ii) 500 cricket bats which had originally cost £70 each and usually sell at £120. These bats had been stored outdoors all summer and had deteriorated significantly. Remedial work in September cost £10 per bat and they were sold in October for £75 each.

What should the value of closing inventory be in the financial statements as at 31 August?

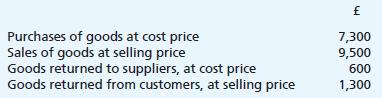

(e) Georgia runs a trading business and sets all her prices to ensure a gross profit margin of 45%.

For her year ended 31 May, she performed a stocktake on 5 June which resulted in an inventory valuation of £123,600 at cost. During the five days from 1 to 5 June, the following transactions occurred:

What figure for closing inventory should be included in Georgia’s financial statements?

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood