You are required to answer the following five questions: (a) Vinnys business only sells one product, and

Question:

You are required to answer the following five questions:

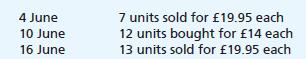

(a) Vinny’s business only sells one product, and his opening inventory at 1 June is 23 units valued at £12 each. The following movements then occur:

What is the value of this business’s closing inventory at 30 June using the FIFO method?

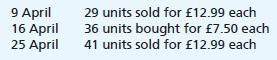

(b) Andrei is a wholesaler of electrical goods. The opening inventory of one his business’s products at 1 April is 53 units valued at £6.00 each. The following movements in this product then occur in April:

What is the value of the units of this product in the business’s closing inventory at the end of the month using the average cost (AVCO) method?

(c) After the draft financial statements of Alfie’s business had been prepared, some inventory was found in a corner of his warehouse which had not been included in the year-end inventory count. On checking the records, it is found that this inventory originally cost £420, but it is thought that it can only be sold for £150. What will be the effect of this discovery on the business’s profit for the year? Explain your answer.

(d) Bert started business on 1 January, buying and selling a single item (Product X). The business traded very successfully in its first year, although the purchase price of Product X did rise steadily and continuously over the course of the 12 months. Bert used the FIFO method of inventory valuation in his first set of financial statements. What would have been the effect on his net profit if he had used the average cost (AVCO) method? Explain your answer.

(e) Cynthia runs a wholesaling business. She always sets her selling prices by adding a 35% mark up on cost. During her financial year just ended, she took goods from inventory with a total selling price of £540 to give as Christmas presents to her friends. Before making any entries or adjustments for this in her books, she calculated a draft net profit for the year of £22,000. What is her correct profit?

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood