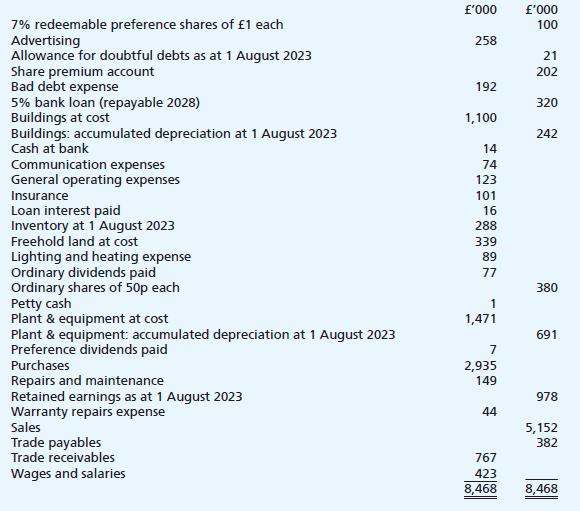

The following trial balance has been extracted from the nominal ledger of Epicteta Ltd on 31 July

Question:

The following trial balance has been extracted from the nominal ledger of Epicteta Ltd on 31 July 2024:

In addition to the above trial balance, you are given the following information:

(i) Closing inventory at 31 July 2024 was valued at a cost of £267,000. This valuation does not take account of the fact that, at the year-end physical inventory count, it was discovered that certain goods with an original cost of £38,000 had been very badly damaged. The scrap value of these goods is thought to be only £5,000.

(ii) The trade receivables figure in the above trial balance includes a debt of £17,000 which is considered irrecoverable. Based on an analysis of the company’s debt collection experience, the allowance for doubtful debts requires adjustment to 4% of trade receivables.

(iii) The bank reconciliation reveals that bank charges of £4,000 appearing on the company’s July 2024 bank statement have been omitted from the accounting records.

(iv) Depreciation is to be provided for the year on the buildings at 2% straight line and on plant &

equipment at 35% using the reducing balance method.

(v) Repairs and maintenance includes a payment for a maintenance contract of £57,000, which covers the six months to 30 November 2024.

(vi) Advertising expenses of £23,000 were incurred before the year end but have not yet been accounted for.

(vii) In June 2024, the land was professionally valued at £595,000. The directors wish to recognise this valuation in the financial statements.

(viii) As of 1 August 2023, the company started offering a 12-month warranty on the goods it sells.

The trial balance indicates that costs of £44,000 to repair goods under these warranties have already been incurred during the financial year. Management estimate that 2% of all warranties will ultimately be exercised and that the future costs of further repairs in relation to goods already sold will amount to £66,000.

(ix) During July 2024, the company made a 1-for-4 bonus issue of its 50p ordinary shares. Management had intended to use the share premium account for this. However, no entries whatsoever have yet been made in the books in respect of the issue.

(x) Corporation tax due on the profit for the year is calculated to be £82,000. (This estimate is unaffected by the various matters above.)

Required:

In a publishable format, produce an income statement for Epicteta Ltd for the year ended 31 July 2024 and a balance sheet as at that date.

Step by Step Answer:

Frank Woods Business Accounting An Introduction To Financial Accounting

ISBN: 9781292365435

15th Edition

Authors: Alan Sangster, Lewis Gordon, Frank Wood