Thomas Smith, a retail trader, has very limited accounting knowledge. In the absence of his accounting technician,

Question:

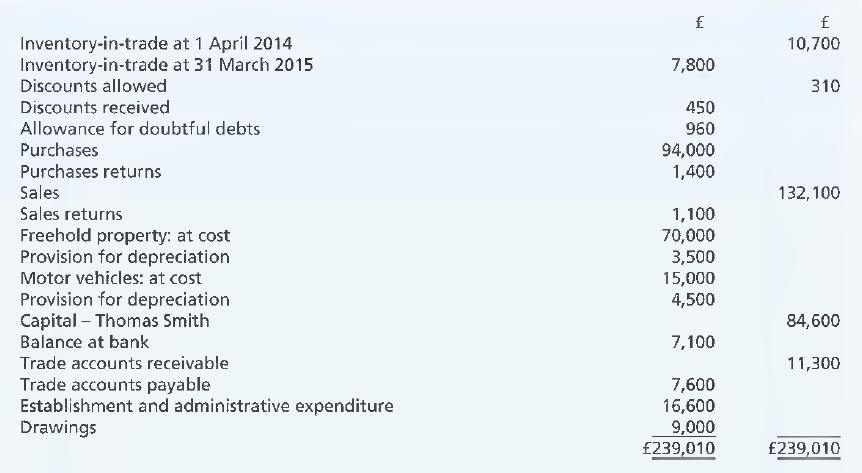

Thomas Smith, a retail trader, has very limited accounting knowledge. In the absence of his accounting technician, he extracted the following trial balance as at 31 March 2015 from his business's accounting records:

Required:

(a) Prepare a corrected trial balance as at 31 March 2015.

After the preparation of the above trial balance, but before the completion of the final accounts for the year ended 31 March 2015, the following discoveries were made:

(i) The correct valuation of the inventory-in-trade at 1 April 2014 is £12,000; apparently some inventory lists had been mislaid.

(ii) A credit note for £210 has now been received from J. Hardwell Limited; this relates to goods returned in December 2014 by Thomas Smith. However, up to now J. Hardwell Limited had not accepted that the goods were not of merchantable quality and Thomas Smith's accounting records did not record the return of the goods.

(iii) Trade sample goods were sent to John Grey in February 2015. These were free samples, but were charged wrongly at £1,000 to John Grey. A credit note is now being prepared to rectify the error.

(iv) In March 2015, Thomas Smith painted the inside walls of his stockroom using materials costing £150 which were included in the purchases figure in the above trial balance. Thomas Smith estimates that he saved £800 by doing all the painting himself.

(b) Prepare the journal entries necessary to amend the accounts for the above discoveries. Note:

narratives are required.

Step by Step Answer:

Frank Woods Business Accounting Volume 1

ISBN: 9781292084664

13th Edition

Authors: Alan Sangster, Frank Wood