The following statement of financial position has been prepared by your client, Mr Conman, proprietor of the

Question:

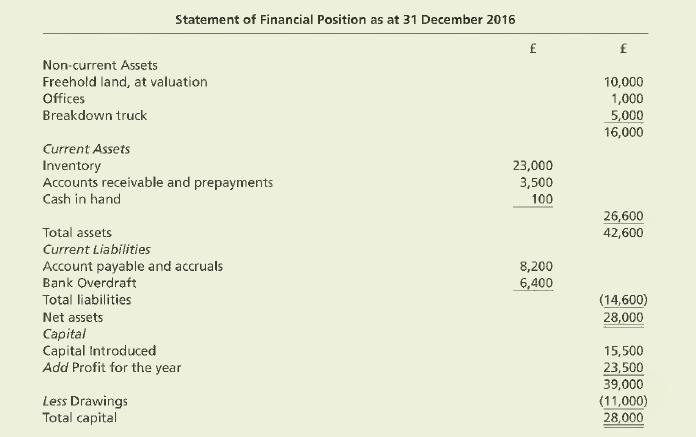

The following statement of financial position has been prepared by your client, Mr Conman, proprietor of the Sleasy Cars second-hand car dealership:

This was the first year of trading for Sleasy Cars. Mr Conman acquired a field in Hull (which had previously been used for a rubbish tip and then filled in) for £5,000 on 1 January 2016 and erected a portacabin on the site to be used as an office at a cost of £500. He then bought ten second-hand cars from a national dealership for £10,000. He has some accountancy training and has taken a lot of care in producing the statement of financial position but confesses that he did not produce a statement of profit or loss. Instead, as it must be the correct figure, the amount shown for profit in the statement of financial position was the amount required to make it balance.

The following points have come to light in your discussion:

(1) The office was bought at a discount from a friend who had acquired it from a builder's yard and Conman has included it in the statement of financial position at the proper price as he knows that accountants like original costs to be shown. The office should last for five years and Conman agrees that maybe that thing called depreciation should be included at straight line. The office will be worthless at the end of the five years.

(2) The land was a bargain. Conman heard on the grapevine that the council were going to take the previous owners to court as it was an environmental hazard. The owners put it up for sale at £10,000 so he made an offer to the owners of £5,000 which was accepted. He is ignoring the court order to clean up the site since this would cost approximately £3,000. His reason for ignoring it is that although the order was made in December 2015 (i.e. before he bought the land), he did not receive the notice until January 2017 (i.e. after he had bought the land).

(3) The breakdown truck is very old and was bought at the start of the year. It has been shown at cost although it is probably only going to last another year and will have no residual value.

(4) Inventory has all been valued at cost although on one car there is a good chance that it will sell at a loss of £500. Another one was sold in January 2017 for £3,000 but the new owner has not picked it up yet - the profit was £1,500 so this has been included in the valuation of the car. As he has included the car, Conman has not included the debtor in the statement of financial position.

(5) A customer has owed £2,000 for six months and Mr Conman is becoming slightly bothered. The customer has moved away from the address she gave Mr Conman and he thinks that this debt might not be recoverable.

(6) After hearing the above, you have decided to check the figures and have found that the cash, overdraft and drawings figures are correct and also that there has been no adjustment for the fact that he has not paid his electricity bill of £250 nor his telephone bill of £150. The reason for this is that he is subletting part of the field and is owed £400 in rent and, therefore, the two cancel each other out.

Required:

(a) A revised statement of financial position after taking into account all of the above.

(b) A description of each of the adjustments that have been made and why each of them is necessary.

Step by Step Answer:

Frank Woods Business Accounting Volume 1

ISBN: 9781292084664

13th Edition

Authors: Alan Sangster, Frank Wood