After he had inherited R50 000, Mike Hill decided to start a steam cleaning business, called Pro-Clean.

Question:

After he had inherited R50 000, Mike Hill decided to start a steam cleaning business, called Pro-Clean.

Transactions for May:

1 Mike opened a bank account in the name of his business, Pro-Clean. He deposited R35 000 of his cash into the business’s bank account as his capital contribution. Mike signed a lease agreement with Syfrets Trust for offices in Wynberg. He gave them a Pro-Clean cheque for R2 100 for rent for the first three months.

The necessary steam cleaning equipment was purchased from Clean Care (Pty) Ltd for R9 000 and the debt was to be paid over the next nine months in equal instalments. At the same time cleaning materials were bought and paid for by cheque, R480.

3 Mike increased his capital by contributing a Toyota Hi-Ace to the business, worth R12 640. This would transport the equipment to the various jobs.

Received an invoice from Modquip for office furnishings installed by them, R14 640.

Issued a cheque for a trading licence, R850.

Received calling cards and letterheads printed by City Printers and gave them a cheque for R105.

8 Mike received R583 for services rendered. These customers were invoiced for work done during the month:

14 Cleaning materials arrived today invoiced to the business at R751. The business has an account with Clean Care (Pty) Ltd, the suppliers.

Received an account for advertising done by The Argus, R145.

Paid the staff their wages by cash cheque, R245.

20 A cash cheque for R200 was drawn to create a cash float. Received a statement from Office Stationers for receipt books, etc. delivered at the beginning of the month and gave them a cheque for R78 to settle the account.

25 Received a cheque from S. Jones to settle her account.

Paid the annual insurance premium on the van to Norisk Insurance Company, R192.

Issued a cheque to Clean Care (Pty) Ltd to pay the first instalment and settle the account for the cleaning materials purchased on 14 May.

Received the bank statement and noted these charges: services fees, R46.

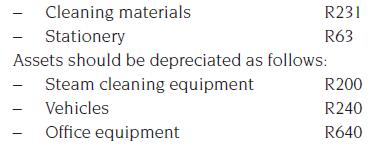

31 The following was ascertained to apply the matching concept:

Both rent and insurance were partially prepaid.

You are required to:

1. Enter the transactions in the general journal. Ignore narrations.

2. Post the transactions to the general ledger accounts.

3. Close the nominal accounts to the profit and loss account passing general journal entries and posting to the ledger accounts. What is the expected annual return on equity for the month?

4. Prepare a draft statement of financial position as at 31 May.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit