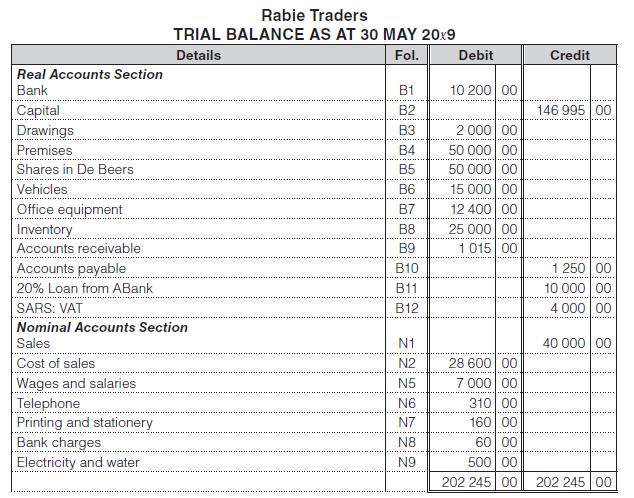

Rabie Traders uses the perpetual inventory system to account for its inventory. The pricing policy of

Question:

Rabie Traders uses the perpetual inventory system to account for its inventory.

• The pricing policy of the business is to mark goods up by 50% on cost.

• All money received is deposited daily.

• All payments are made by cheque. VAT @ 14% must be accounted for on appropriate transactions.

Transactions for June 20x9:

1 Sent a cheque Z25 to SARS for the VAT amount outstanding from May.

3 Bought goods from D. Delmas on credit for R1 596 (invoice 41).

Sold goods for cash, totalling R6 000 VAT exclusive (CS 70–80).

4 Paid R2 000 on the loan from ABank.

5 Sold goods with these cost prices on credit to:

7 Bought goods for R820.80 and stationery for R262.20 from E. Els on credit.

8 Bought stationery from Krige Stationers. Paid the R273.60 by cheque.

Sent a cheque for R1 000 to E. Els to settle our account with them as at 1 June. Sold goods that cost R400 on credit to L. Zikane.

10 The owner took a typewriter no longer in use by the business, R1 000 (no VAT).

Sold goods to B. Botha on credit for R720, selling price, VAT exclusive.

15 Purchased stationery on credit from Krige Stationers, R171.

Received a cheque for R215 from A. Altman in full settlement of his account as at 1 June, (receipt R721 issued).

16 Returned goods to E. Els and received his credit note, R136.80.

17 Donated goods to Tygerhof Primary School for their event, R500 cost price (no VAT).

18 Sold goods to B. Botha on credit. The invoice VAT inclusive totalled R444.60.

Bought goods from G. Nkosi and paid the R706.80 by cheque.

19 Sold an old filing cabinet to A. Altman on credit for R700 (no VAT).

Charged B. Botha R15 interest on his account that was overdue.

20 Received R4 788 for goods sold to customers for cash (CS 81–90).

21 B. Botha sent us a cheque for R1 500 in part payment of his account.

23 Purchased a new delivery vehicle from Parys Motors for R35 500 on credit.

24 Sold an old vehicle to R. Venter for R15 000, and received his cheque (no VAT).

25 Sent cheques to pay for:

![]()

26 Goods were returned by L. Zikane (cost price R100) and B. Botha (cost price R120).

27 Paid R250 to D. Delmas in settlement of the amount owing on 31 May.

28 Received a cheque for rent of premises sublet to L. Lategan, R319.20.

29 Received a cheque for R22 from L. Zikane. Drew a cash cheque for wages, R2 400.

E. Els sent notification that he had charged R10 interest on overdue account.

30 Received a credit note from Krige Stationers for R57 for stationery returned.

You are required to:

1. Enter the transactions for June 20x9 in these journals:

a. Cash receipts journal.

b. Cash payments journal.

c. Accounts receivable journal.

d. Accounts payable journal.

e. Accounts payable allowances journal.

f. Accounts receivable allowances

g. General journal. journal.

2. Open all the general ledger accounts and post from the subsidiary journals.

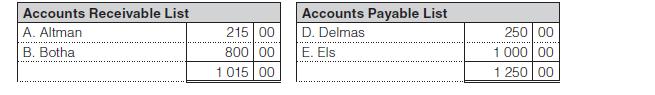

3. Open the accounts receivable and accounts payable ledgers and post from the subsidiary journals. a Balance all accounts in the general ledger and the subsidiary ledgers and draft a accounts receivable and accounts payable list.

b. Compare the list totals with the balances of the accounts receivable and accounts payable accounts.

4. Draft a trial balance at 30 June 20x9.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit