G, J and L were in partnership sharing profits and losses in the ratio 3 : 5

Question:

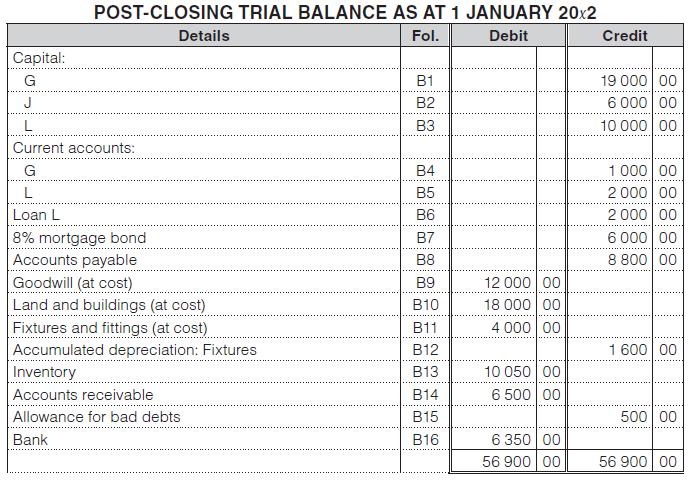

G, J and L were in partnership sharing profits and losses in the ratio 3 : 5 : 2. On 1 January 20x2, they decided to dissolve the partnership as J was personally insolvent. The partnership’s post-closing trial balance at that date was:

The realisation transactions are summarised as follows:

1. G agreed to take over the land and buildings for R20 000 and to assume liability for the mortgage bond.

2. The fixtures and accounts receivable were disposed of for R7 400 cash.

3. Inventory was sold by public auction for R6 350 cash.

4. Paid auctioneer’s fee of R100.

5. As the tangible assets have been disposed of separately, the goodwill has no value.

6. Paid payables R8 400 in full settlement of their claims.

7. Divided the loss on realisation amongst the partners.

8. Paid L R2 000 for his loan.

9. Divided J’s deficiency amongst G and L (applying the rule in Garner vs Murray).

10. Distributed the remaining cash to the partners.

You are required to:

1. Assuming that the partnership makes use of a profit and loss on realisation account, prepare entries in the general journal to record:

a. The sale of the assets.

b. Payment of payables.

c. Division of the loss on realisation.

d. Payment of partner’s loan.

e. Division of the insolvent partner’s deficiency.

f. Distribution of cash to the partners.

2. Set up ledger accounts for cash in the bank, profit and loss on realisation, the partners’ capital accounts, and record the appropriate entries for dissolving the partnership.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit