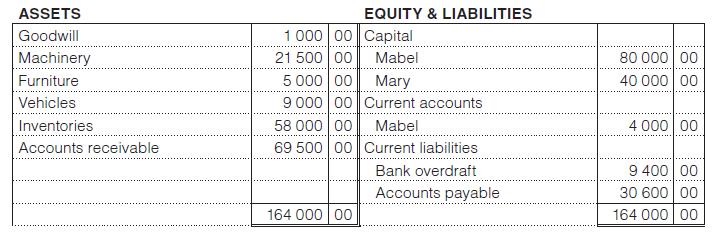

This information appeared in the books of Mabel and Mary on 31 March 20x5. The partners share

Question:

This information appeared in the books of Mabel and Mary on 31 March 20x5. The partners share profits and losses in the ratio of 2 : 1.

On 31 March 20x5, the partners decided to dissolve the partnership and to sell its assets to Mark Ltd for R150 000.

1. All liabilities were settled by the partnership.

2. Payables were paid by cheque, R30 000.

3. Dissolution cost was paid by cheque, R100.

4. Mark Ltd paid the purchase price by issuing 12 000 fully paid shares of R10 each to the partners and the difference in cash.

5. The partners are to divide the shares in their profit-sharing ratios.

Cash must be paid in or withdrawn by the partners so that their capital accounts close.

You are required to:

Use these ledger accounts to show the dissolution of the partnership:

1. Bank account.

2. Profit and loss at dissolution.

3. Capital accounts of Mabel and Mary.

4. Mark Ltd’s account.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit