Greenlawns Garden Services (owned by R. Scott) has employed you to write up their books for September.

Question:

Greenlawns Garden Services (owned by R. Scott) has employed you to write up their books for September. The business specialises in landscaping and garden maintenance.

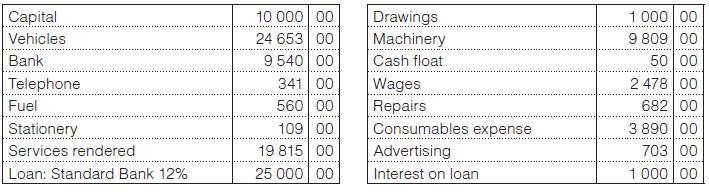

These balances appeared in the general ledger on 1 September.

Transactions for September:

1 Paid the telephone account for August, R56 (C81). Cash takings from services rendered, R1 678 (receipts 100 to 112).

4 Bought a lawn mower from Lawns Unlimited and paid by cheque, R483. Green Grow delivered the manure and fertilisers ordered. Gave them a cheque for R253.

9 Sold an old second-hand mower at carrying value and received a cheque for R105. Received an account from the Constantiaberg Bulletin for advertisement placed, R20. Sent a cheque to settle the account.

Greenlawns landscaped a half-acre garden. Received a cheque for R2 500 for the job.

15 The owner sent a bowl of flowers to his wife and paid for them with a business cheque of R30. (Remember this is drawings, that is, not a business expense.)

Sent a cheque to Bobby’s Motors to pay for repairs to the business’s bakkie, R132 and to his son’s car, R75.

17 Paid the wages of the staff, R469.

28 Sent a cheque to the Standard Bank to repay R2 000 of the loan as well as the interest due this month.

Received an account from Bobby’s Motors for fuel, R152. Issued a cheque.

Money received from clients for gardening services completed, R2 879.

Bought a printer for R900 and ink cartridges for R75 from Rank Xerox. Paid by cheque.

You are required to:

1 Journalise the transactions for the month, and post them to the general ledger.

2 Extract a trial balance as at 30 September. Provide your workings in the form of the ledger accounts.

3 Indicate what further adjustments may be necessary to achieve good matching and a more accurate indicator of financial performance for the month.

Step by Step Answer:

Fundamental Accounting

ISBN: 9781485112112

7th Edition

Authors: David Flynn, Carolina Koornhof, Ronald Arendse, Anna C. E. Coetzee, Edwardo Muriro, Louise Christel Posthumus, Louise Mancy Smit